The second wave of the COVID-19 pandemic in India has unleashed mayhem across the country, precipitating a severe health and humanitarian crisis in its wake. Claims due to COVID-19 illness have seen a sharp rise, and both general and health insurers are feeling the heat. “We have observed that in the last seven days, COVID-19 claims coming in the form of ‘cashless claims’ have more than doubled and are rising at a very fast pace,” says Dr Bhabatosh Mishra, Director, Underwriting, Claims and Product, Max Bupa Health Insurance. The company says it has settled COVID-19-related claims worth over Rs 150 crore so far.

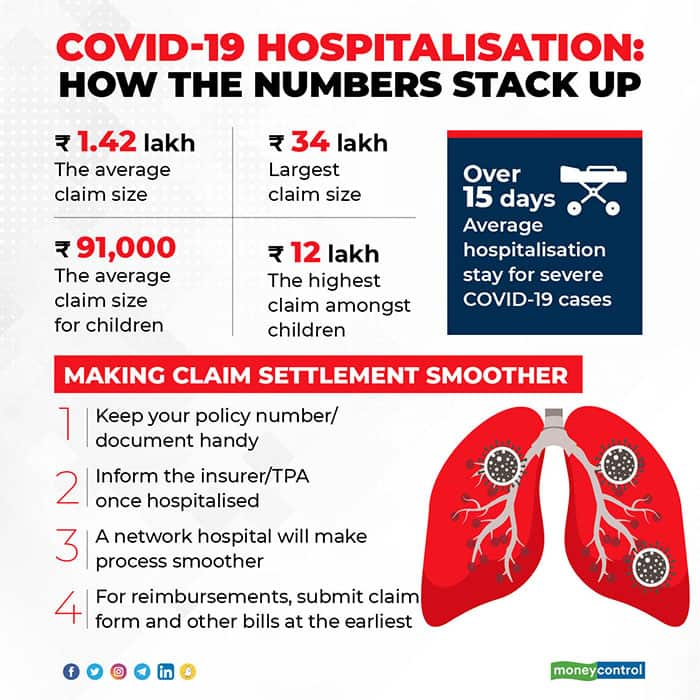

The average claim size settled so far is about Rs 1.42 lakh for Max Bupa, but in some cases the claim size has gone up to Rs 34 lakh. “A lot of mild-to-moderate claims can be treated at home, but some doctors advise hospitalisation as a defensive practice. Patients get admitted due to the panic around COVID-19. There is a need to kill this fear – beds are needed for severely ill patients,” says Dr S Prakash, Joint Managing Director, Star Health and Allied Insurance.

Younger population affected too

Moreover, unlike the first wave, which largely saw individuals over 60 needing hospitalisation, this time, even younger people have had to seek emergency medical help. “We are handling 5,000 claims per day. We have seen an increase in claims from the younger population,” says S Prakash.

Dr Narendra Dedhia, President of the Indian Medical Association, Central Suburbs (Mumbai) attributes the surge to lowering of guard by younger individuals in the recent months. “Due to the stringent lockdown during the first wave, the younger population had to stay put at home. Once it was eased, many started going to work, restaurants, marriages and parties, which eventually contributed to the second wave. Also, many senior citizens have now been vaccinated, which is not the case with the younger lot,” he explains.

“Around 14 percent of our COVID-19 claims are of children and their parents. The average claim paid for children is Rs 91,000 and, in some cases, it has gone up to Rs 12 lakh,” says Mishra. “In the case of parents, the average COVID-19 claim paid is Rs 1.71 lakh, which has gone up to Rs 14 lakh. The majority of these claims have been settled in Delhi NCR, Mumbai, Bangalore, Pune and Hyderabad,” he added. Star Health has seen claims coming largely from Mumbai, Delhi, Pune, Ahmedabad, Chennai and Hyderabad. The dominance of cities in the claim list is not surprising, given the low health insurance penetration in non-metro cities.

Longer stay at hospitals for critical COVID cases

The hospitalisation incidents of mild to moderate cases have decreased.

However, patients with severe COVID-19 have had to spend more time in hospitals. “In the first wave, severe cases needed hospitalisation of 8-15 days, but this time around, it is over 15 days. On an average, such patients now need to spend 5-7 days more in the hospital until their condition stabilises,” says Nikhil Apte, Chief Product Officer, Health Insurance, Royal Sundaram General Insurance.

On the other hand, in the last two weeks, insurers have seen fewer mild to moderate case claims, as hospitals shift focus to severe cases. “Three weeks ago, mild to moderate cases were getting admitted, now it is difficult. We have observed that the key parameter that hospitals are focussing on is the oxygen level. Only those who require external oxygen support are being admitted to the hospital,” he adds.

COVID claim woes

COVID-19 cases in the second wave exploded in a short span of time, burdening hospitals as well as health insurers’ infrastructure. “Initially, in the second wave, the number of COVID claims did not match the number of cases. But now, the cases are increasing at a rapid pace,” says Mishra. “Besides, a few network providers have started refusing cashless claims to COVID patients. So, insurers are ending up paying more than the agreed tariff.”

Moreover, now delays in claim settlement are inevitable due to the spiralling COVID-19 cases, say industry players. “We have seen insurers co-operating, but there have been delays in cashless settlements due to paucity of staff and resources – both at hospitals and insurers’ ends. This is on expected lines due to the heavy volume of cases,” says Priti Salvi, Senior Manager, Claims, Xperitus Insurance Brokers.

However, some argue that the insurance industry as a whole is in a better position to deal with the second wave of claims. Insurers say that the experience of handling thousands of claims last year has equipped them in dealing with the second wave. “Claim processing executives have a better idea on settling claims, as they have now handled lakhs of COVID claims over the last one year. Treatment protocols are clearer. Friction between insurers and hospitals has reduced. We have seen that hospitals are now acting more fairly,” says Apte.

Last year, hospitals were stung by postponement of elective surgical and other treatment procedures, which are key contributors to their revenues. They saw their revenues dip as they were forced to earmark beds for COVID-19 patients and could not charge beyond state government-fixed ceilings. Some hospitals refused to pass on the benefits of lower costs to insured patients, say insurers. “So, insured COVID-19 patients’ bills have shot up, as some hospitals argued that government ceilings were not applicable to them. Insurers and hospitals also differed over treatment protocol, which is not the case today,” says a senior insurance official, who spoke on the condition of anonymity.

At your end, you need to ensure that you have your health insurance policy number and policy document handy at the time of hospitalisation. It is best to go digital and save soft copies in your mailbox. Intimate the insurer and TPA as soon you are hospitalised. While it is best to locate a network hospital for treatment, the current scenario makes it difficult to find a hospital of your choice. In case of reimbursement claims, submit the discharge summary, along with other bills and claim form, as soon as you recover.