The Indian stock market witnessed a robust resurgence in March 2025, putting an end to a prolonged five-month losing streak that had stretched from October 2024 through February 2025. With renewed investor enthusiasm and favourable economic indicators, both the BSE Sensex and the NSE Nifty closed the financial year 2024-25 (FY25) on a strong and optimistic note. Notably, mid-cap and small-cap stocks delivered particularly impressive returns, outperforming broader indices and attracting considerable attention from retail and institutional investors alike.

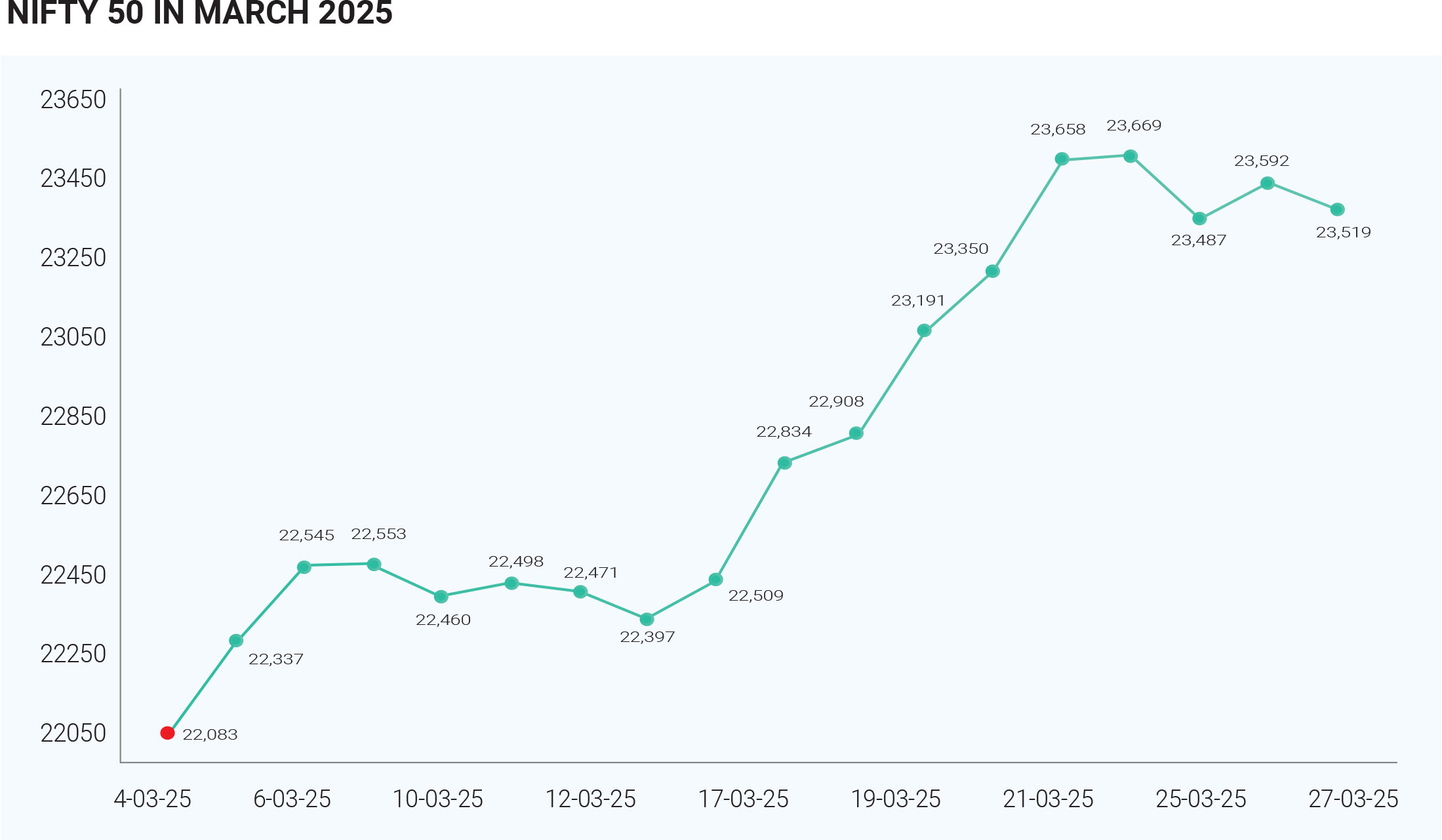

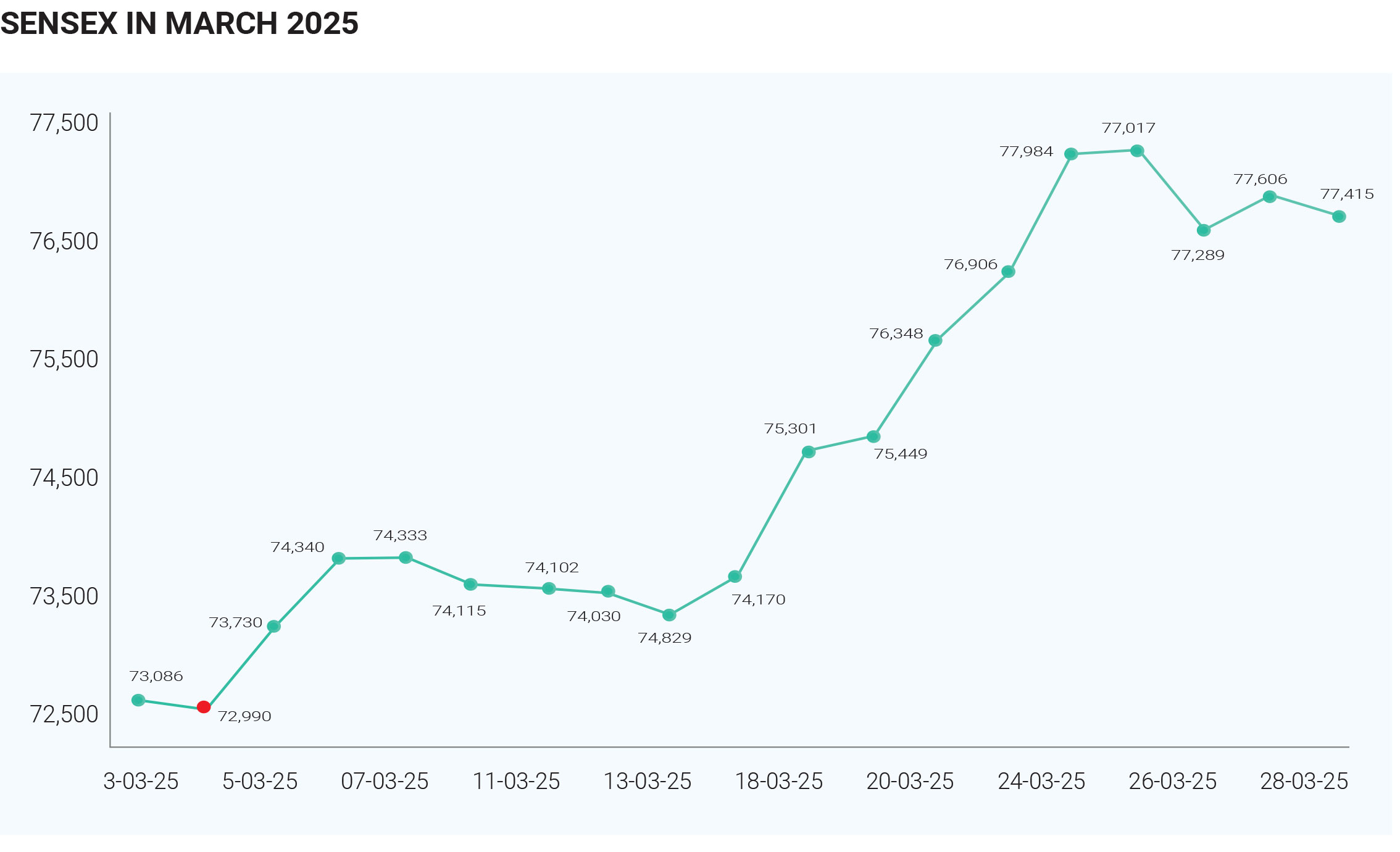

The BSE Sensex recorded a sharp gain of approximately 6.53% over the course of March, effectively reversing some of the losses accumulated earlier in the fiscal year. The index opened the month at 74,608.66 and closed at 76,882.58 on March 31, highlighting a significant upward trajectory. Similarly, the NSE Nifty 50 posted a monthly gain of around 6.3%, starting from 23,356 on March 1 and ending the month at 23,519.35. This marked one of the most positive months for Indian equities in recent times.

A combination of sectoral strength, macroeconomic improvements, and global cues contributed to this bullish trend. Sectors such as financial services and information technology (IT) played a leading role in driving the indices higher. The Indian economy provided a supportive backdrop, with inflation easing to 4.31% in January 2025—closer to the Reserve Bank of India’s (RBI) target. This decline in inflation raised investor hopes for potential interest rate cuts in the upcoming months, thereby fuelling market optimism. Market sentiment was further buoyed by expectations of a rebound in India's GDP, particularly in the fourth quarter of FY25. Investors and analysts anticipated improved economic growth figures, supported by strong industrial output in January 2025, which exceeded market expectations. Government spending remained elevated, and consumer income levels showed an upward trend, both of which contributed to the revival of domestic demand and market performance. Multiple sectors contributed meaningfully to the March 2025 rally, benefiting from the improving domestic macroeconomic landscape as well as favourable global developments. Among the top-performing sectors, energy stood out as the most profitable, registering gains of nearly 10% during the month. This strong performance was largely attributed to global supply-demand dynamics and rising crude oil prices, which helped energy companies post better-than-expected earnings. The financial sector also showed substantial strength, fuelled by improved fundamentals and renewed foreign institutional investor (FII) interest. Major banking stocks like ICICI Bank and Axis Bank were among the top performers, significantly contributing to the gains in the Nifty. These gains reflected growing investor confidence in the resilience of the Indian banking system The IT sector, initially under pressure due to global uncertainties and disruptions in the tech space, recovered gradually as the month progressed. Companies such as Tata Consultancy Services (TCS) and HCL Technologies demonstrated resilience and stability, helping bolster overall market sentiment. The automotive sector saw notable momentum, with companies like Mahindra & Mahindra and Tata Motors recording strong gains amid rising demand and positive sales figures. The metal sector also made a comeback, thanks in part to Chinese stimulus efforts and a weakening U.S. dollar. Stocks such as Hindalco Industries and Tata Steel showed significant strength during certain trading sessions. Healthcare remained a steady performer, supported by robust demand and resilient earnings from key players like Sun Pharma, which attracted renewed interest from both domestic and foreign investors. Large-cap stocks were central to the market’s strong performance in March. Companies like SRF Ltd, Bajaj Finance, and Kotak Mahindra Bank emerged as top gainers among the large-cap segment. Their gains were driven by strong earnings potential, positive economic tailwinds, and heightened investor confidence amid improving domestic indicators. These companies benefited from favourable sectoral dynamics, consistent performance, and their ability to attract institutional capital. Their resilience during the market downturn in previous months made them particularly attractive as the markets turned positive. One of the most significant developments in March was the turnaround in FII behaviour. After months of sustained selling pressure, FIIs became net buyers, signalling a major shift in market sentiment. This reversal acted as a major catalyst for the stock market rally. On March 21, FIIs recorded their largest net equity purchase of the year, infusing ₹7,470 crore into Indian equities in a single day. Over a three-day span, total FII purchases exceeded ₹13,500 crore. This sharp uptick in foreign inflows bolstered market confidence and played a crucial role in driving the Nifty 50 to rise over 6% in just one week—its best performance since February 2021. The Sensex also saw a massive jump, adding ₹22 lakh crore in investor wealth. While a large part of this inflow was attributed to passive investments triggered by FTSE index rebalancing, the broader change in FII sentiment nonetheless supported the rally. However, when adjusted for these mechanical flows, FIIs remained cautious, continuing to show some selling pressure—highlighting that the overall foreign investment appetite was still measured. The strong FII inflows also had a positive impact on the Indian rupee, which registered its best weekly gain in two years. The currency regained all its year-to-date losses, strengthening significantly on the back of renewed foreign interest. As we move into April 2025, a mix of global and domestic factors will likely determine the next phase for the Indian stock markets. Investor focus will be divided between international developments and key local economic indicators. Globally, attention will be centred on the United States, with the release of critical economic data such as GDP growth, employment numbers, and inflation figures. Any major surprises—especially negative ones—could influence global markets, including India. Furthermore, changes in U.S. trade policy, particularly any announcements related to tariffs, will be closely watched. A protectionist approach could dampen sentiment in emerging markets, whereas a more open stance might spark optimism. On the domestic front, inflation and interest rate trends will remain in the spotlight. The RBI’s upcoming policy stance will be critical—especially if inflation continues its downward trajectory, paving the way for potential rate cuts. Such monetary easing could inject liquidity into the system and support market expansion. India’s GDP data for the fourth quarter of FY25 is also expected to play a pivotal role. Strong growth figures would further reinforce the positive market outlook and attract both retail and institutional investors. Continued strength in industrial production, government spending, and consumer demand will be vital in maintaining the bullish momentum seen in March. In summary, while the impressive gains in March have set a strong tone for FY25, sustaining this momentum will depend on a careful interplay of global cues, domestic policy decisions, sector-specific performances, and investor sentiment