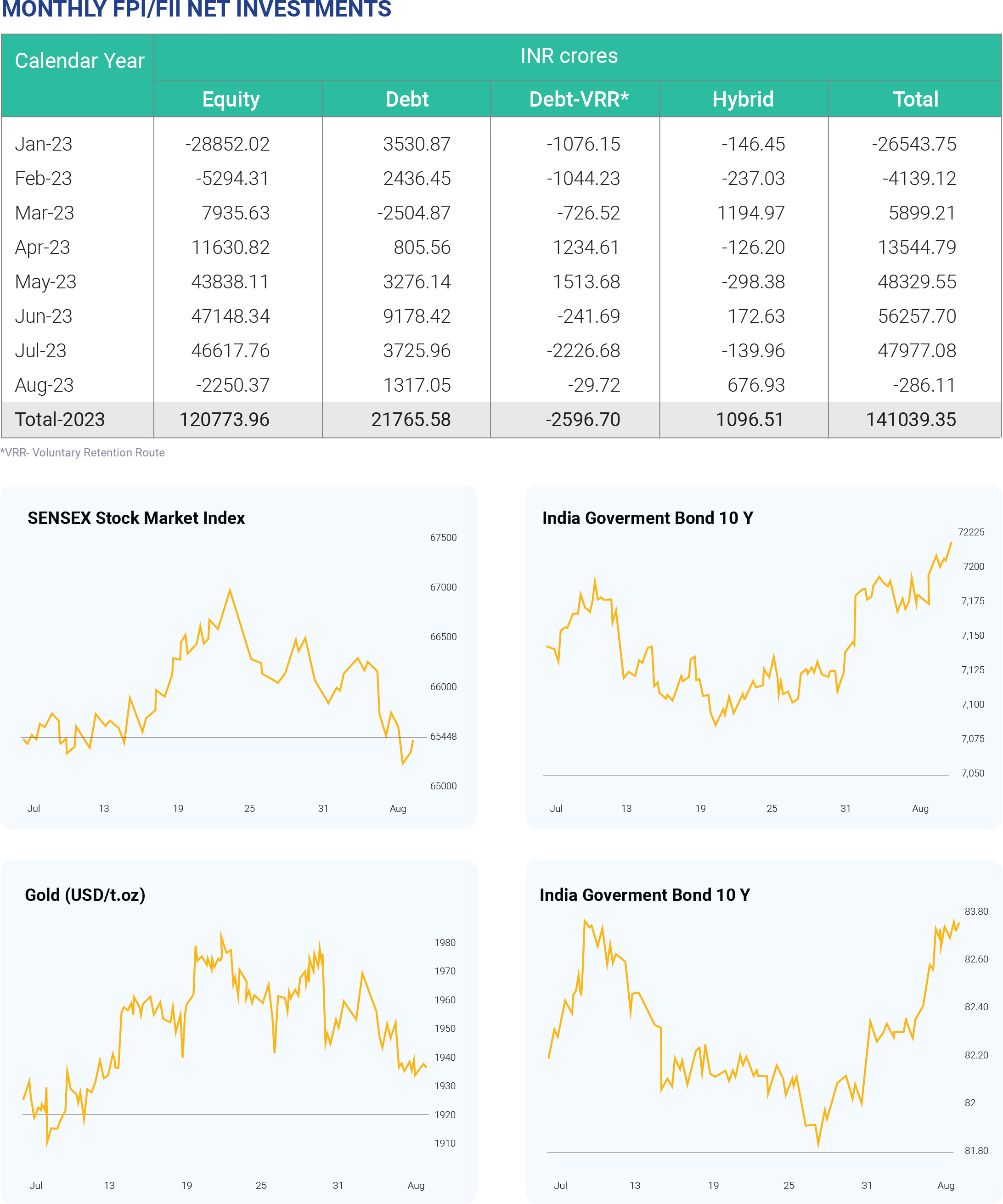

Beginning of the month July 2023 carry forward the gaining streak from June 2023, extensive buying by FIIs in the mid cap and small cap segments prevails. The Sensex moves consistently for first two weeks of July 2023 then peaking out on 20th July 2023. With the favorable domestic economic numbers along with interest rate cycle peaking out and India’s current account deficit contracted in Q4FY23, the FIIs aided the market sentiment. The positive forecast from Asian Development Bank (ADB) for India’s economic growth at 6.4% for FY24 and 6.7% for FY25 on the back of domestic demand with easing of inflation. As the month ends, International Monetary Fund (IMF) also releases the optimistic forecast for India’s growth to 6.1% for FY24 and 6.3% prediction for FY25, with the strong domestic investment but warned about the global economic conditions countries struggling to curb the inflation around the world. After record breaking GST collection now the centre starts the disbursements to the states their shares. In June, India’s inflation rate was 4.81%, which remains within the Reserve Bank of India’s tolerance band of 2% to 6%. The central bank has left interest rates unchanged at 6.5% since April 2023. On 26th July 2023, US Fed hiked the interest rate by 25 basis points from 5.25 to 5.5%, as Fed noted that the inflation remains elevated, but the economic numbers show improvement. Indian stock markets faced the volatile period during the month also the Q1 results of IT sector were discouraging fuelled by the profit booking by investors. The Indian financial analysts are betting on financial sector, FMCG, auto, manufacturing, capex, and healthcare in coming months. Foreign portfolio investors (FPIs) bought ₹45,365 crore in Indian equities in July which has been marginally lower than the total investment made in June 2023. According to NSDL data, FPIs infused ₹46,581 crore in Indian markets in July, considering debt, hybrid, debt-VRR, and equities. However, the foreign funds inflow was driven by a strong rally in Indian markets with Sensex and Nifty 50 hitting new lifetime highs this month. Making India the most favorable among the emerging markets receiving highest FPI flows. In the last week of July, FIIs turned net sellers and offloaded a total of ₹5,003.35 crore in Indian equities, snapping its consistent buying streak that helped sustained a record rally in domestic benchmark Nifty this month. Nifty has rallied around 5% in July and 15% in the current fiscal so far mainly on foreign capital inflows and the momentum led by first quarter results of fiscal 2023-24 (Q1FY24). FIIs offloaded a total of ₹5,003.35 crore in Indian stocks, while DIIs bought a total of ₹4,162.52 crore in equities.

The debt market experienced instability due to US economic numbers and the US Fed rate hike. Although yields were stable in the first week of July, the US Fed rate hike and economic numbers caused the US Treasury yields to drop, which in turn caused Indian yields to become positive. In the forex market, the rupee decreased by 7 paise to 82.25 against the US dollar in early trade on the last day of the month due to the strong US dollar and foreign funds leaving the domestic equity markets. The Indian currency was also pressured by crude prices reaching over USD 84 per barrel and subdued sentiment in the domestic equity markets. The most favorable haven for investors, Gold prices showed steady growth in anticipation of ending the rate hike cycle by the US Fed. Crude prices also soar on the back of Saudi and Russia announcing production cuts soon, escalating geo-political tensions between Russia and Ukraine. The improving economic conditions in US and China also aided the rise in crude prices. Although Indian markets may experience volatility, the country's good economic conditions could protect against the ongoing economic and geopolitical issues around the world. However, economic decisions made by China and the US could have a significant impact on our markets and put pressure on our economy. Additionally, the increasing crude prices could have a negative effect on inflation. Concerns about food inflation in the coming months are also increasing due to the impact of heavy rains on crops. The upcoming elections in the country may not be helpful for the Indian market either. Short-term corrections in the market are inevitable, so investors should take advantage of this by investing according to their risk appetite.