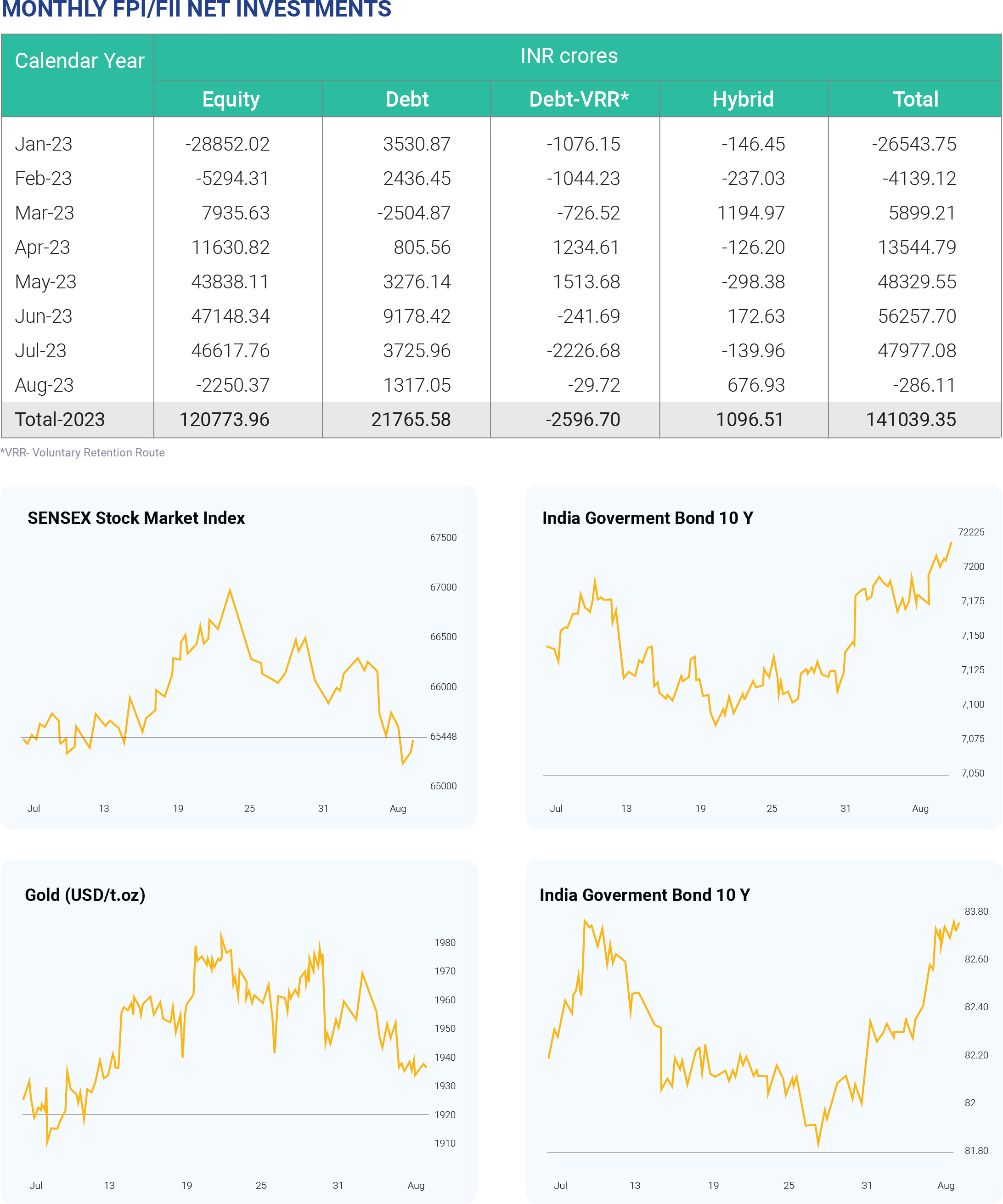

With nominal gains in the month of April 2023 the markets remain towards the positive side in the month of May 2023 as the upbeat corporate earnings and favorable macroeconomic data. The market booked fewer gains than the month of April with NIFTY 50 and the BSE Sensex clocked a near 2.5% rise for the month of May. The sectors which continue to outperform includes auto, realty, and consumer durable goods. The US Fed rate hike on 4th May has raised the concern over the US economic crisis. With the uncertainty of the US banking crisis and the most awaited decision on debt ceiling agreement by the government, affects the financial world all around the world. European commercial banks also hike its rate due to their poor economic data. India’s consumer price index-based inflation (CPI) rose 4.70% in Apr 2023, down from 5.66% in Mar 2023. Consumer Food Price Index (CFPI) also eased to 3.84% in Apr 2023 as compared to 4.79% in Mar 2023. The inflation rate for vegetables contracted 6.50%, while that for cereals rose 13.67% in Apr 2023. Inflation in spices rose 17.43% in Apr 2023. India’s Index of Industrial Production (IIP) growth accelerated to 1.1% in Mar 2023 as against a rise of 2.2% in Mar 2022. Manufacturing output rose 0.5% YoY in Mar 2023. Mining output rose to 6.8% and electricity output contracted to 1.6%. as per the use-based classification, capital goods grew 8.1% in the reported month. According to figures from the Reserve Bank of India, India's foreign exchange reserves increased by $7.196 billion to $595.98 billion as of May 2023. In the last week of Apr 2023, India's foreign exchange reserves rose to a 10-month high of $588.8 billion after falling to $524.5 billion in Oct 2022, when the rupee set a record low versus the U.S. dollar. The monthly economic review for April 2023, the Indian economy is anticipated to see downside risks to growth and upside risks to inflation. This is partially due to difficulties in the nation's external sector as well as weather-related uncertainty. Future inflation predictions for India could be negatively impacted by several variables, including weaker-than-expected oil supply, higher-than-expected Chinese demand, escalating geopolitical tension, and upcoming monsoon season. The withdrawal of Rs.2000 note from the system was announced on 23rd May 2023 as RBI governor stated that sufficient notes in other denominations are there to replenish these 2000 notes. He also stated that the Rs. 2,000 notes will continue to be accepted as legal money and that this is not a demonetization. The value of 2000-rupee notes in circulation are 3.62 trillion Indian rupees ($44.27 billion). This is about 10.8% of the currency in circulation. This withdrawal could affect the short-term interest rates with the increase in liquidity and inflow in bank deposits, which in turn is invested in shorter term government securities. With the good economic conditions India is emerging as a favorable investment alternative to the foreign investors which can be justified by highest FPIs of Rs.43,838 crores in the month of May 2023...