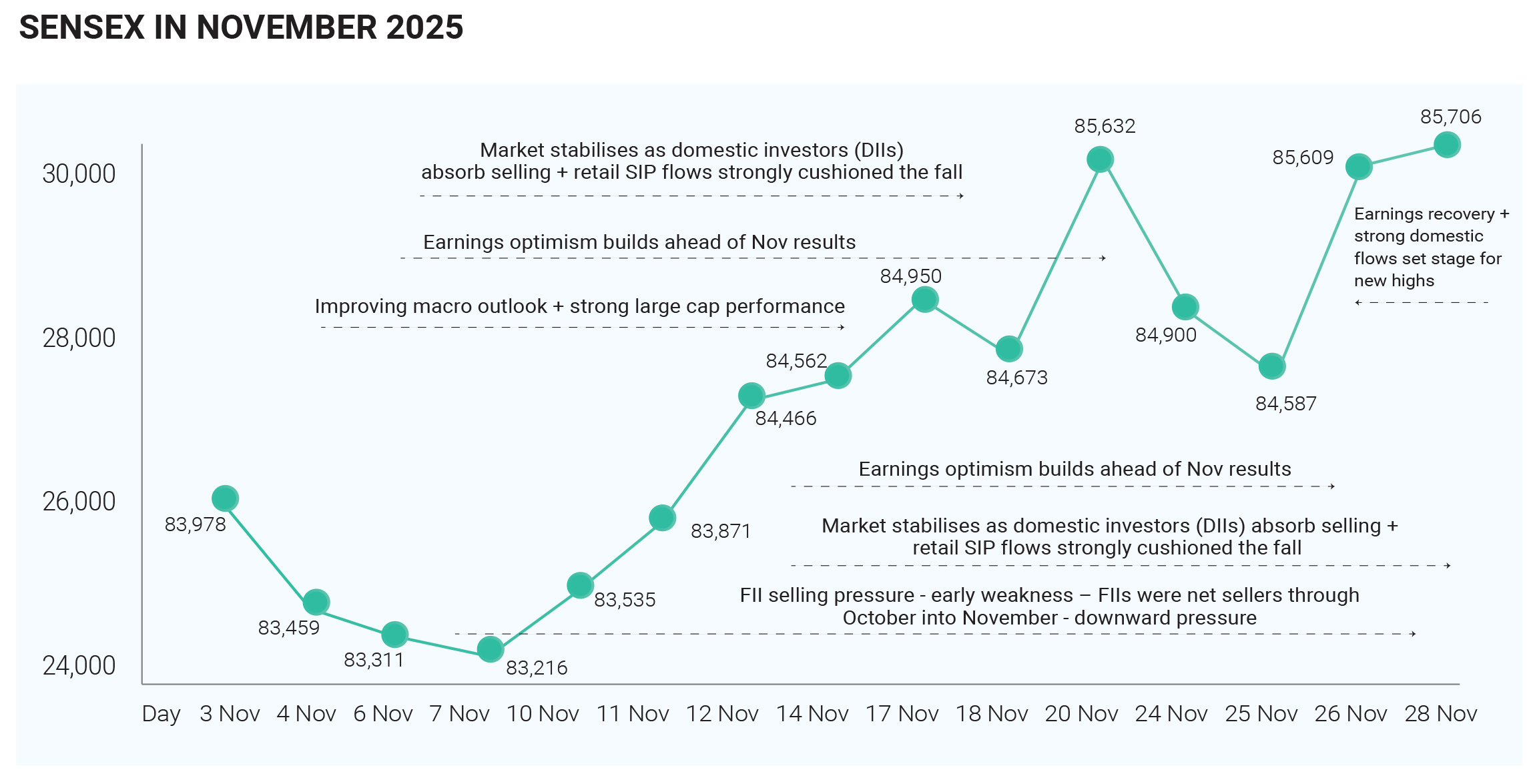

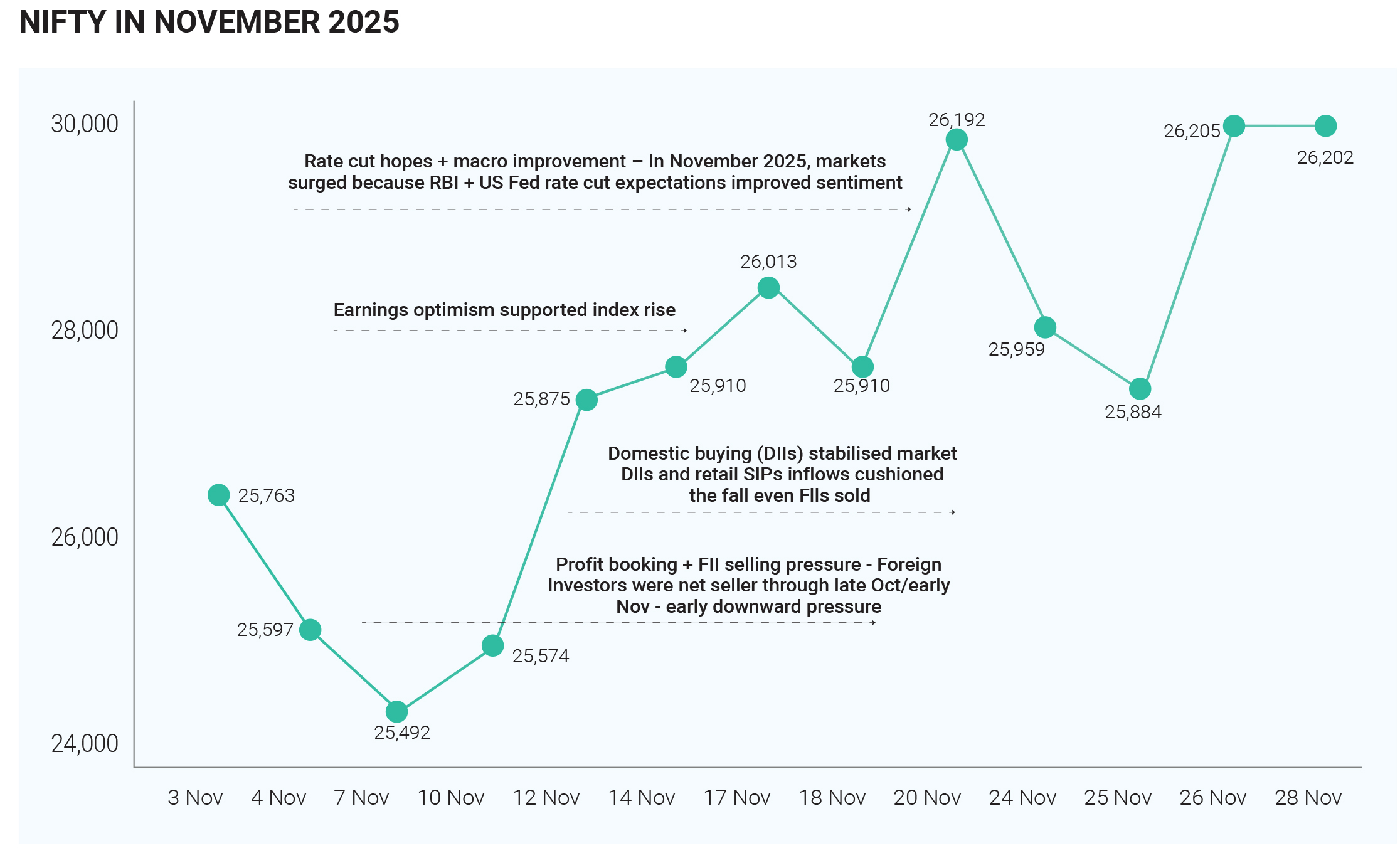

In November 2025, the Indian equity markets continued their upward trajectory, marking the third consecutive month of gains. The Nifty 50 rose by approximately 1.87% during the month, while the BSE Sensex also posted modest gains, oscillating around the 85,000–86,000 range. Despite intermittent volatility and foreign investor selling pressure, domestic institutional support, strong economic data, and sectoral outperformance—especially in technology and healthcare—helped sustain overall market strength. The Sensex touched intraday highs above 86,000 in mid-November before settling slightly lower by month-end. Market breadth remained positive but weaker than in October, with 30 advancing stocks versus 20 declining stocks on the Nifty, resulting in an advance-decline ratio of 1.5. In the final week of November (ending on the 28th), the Sensex gained around 0.56%, reflecting resilience despite turbulence in global and domestic cues.

Technology emerged as the strongest-performing sector

with a weighted return of 4.53%, driven by gains in firms

such as Tech Mahindra, HCL Technologies, and Infosys.

Healthcare also delivered impressive performance at

4.16%, benefiting from defensive positioning and stable

demand. The energy sector gained around 3.49%, lending

additional support to broader indices. In contrast, utilities

proved to be the biggest underperformer, falling by

3.85%. This decline was driven by weakness in

heavyweight stocks such as Power Grid and NTPC,

which were affected by softer power demand and

operational pressures. Consumer defensive stocks also

slipped by 1.95%, reflecting subdued sentiment around

staple goods and cautious consumer spending patterns.

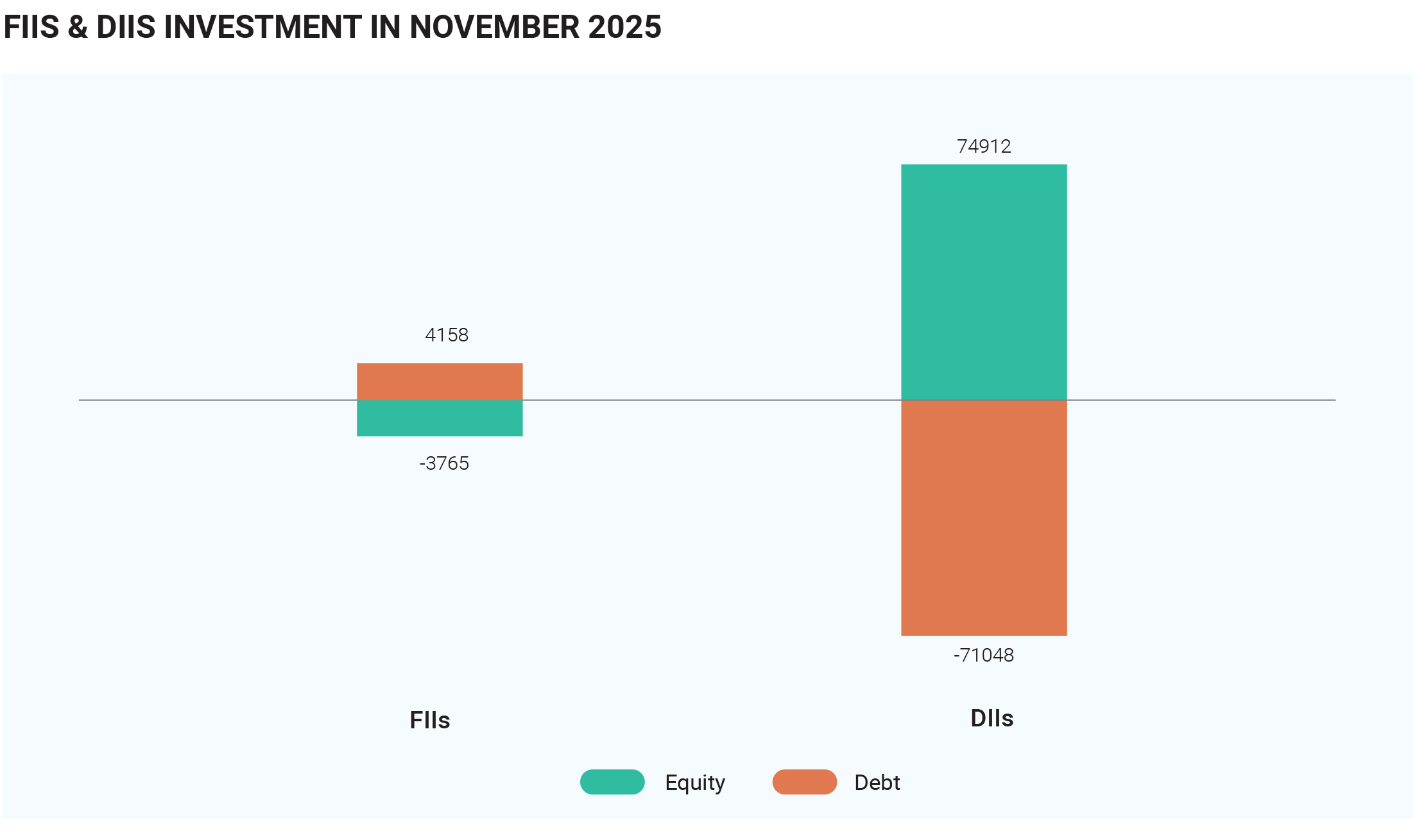

Foreign Institutional Investors (FIIs) emerged as net

sellers in November, pulling out approximately ₹12,500

crore from Indian equity markets in the secondary

segment. This outflow was primarily due to global

portfolio rebalancing towards AI-driven rallies in markets

such as the United States, China, and South Korea. There

were significant days of FII selling, including net outflows

of ₹4,171 crore on November 24 and ₹1,255 crore on

November 27. Although there were some instances of

buying (e.g., ₹4,581 crore on November 7), the overall

monthly trend was negative. However, Domestic

Institutional Investors (DIIs) effectively counterbalanced

the impact of this selling. Indian mutual funds, insurance

companies, and pension funds injected approximately

₹16,600 crore into equities, fuelled by consistent SIP

inflows and rising retail participation. Over the broader

period, DIIs invested nearly ₹77,083 crore (around $8.7

billion), marking approximately 28 consecutive months

of net buying. This sustained influx not only stabilized the

market but also elevated DII holdings above FII holdings

for the first time in recent history. Domestic buying was

concentrated in sectors such as financial services,

FMCG, technology, and healthcare.

Interestingly, while FIIs were net sellers in the secondary

market, they remained active in the primary market. Their

investments in IPOs totalled around ₹10,700 crore,

making November the second-highest monthly FII inflow

in primary markets for 2025. This highlights continued

long-term confidence in India’s structural growth story

despite short-term volatility in stock prices.

Internationally, equity markets experienced turbulence

early in the month. Global technology stocks underwent

a sharp correction, with the Nasdaq Composite falling

nearly 3% in the first week of November. Asian markets,

including Japan’s Nikkei and South Korea’s KOSPI,

dropped around 5% each, while European markets

weakened as well. This selloff was primarily driven by

high valuations and concerns over stretched profit

expectations

related

to artificial

intelligence

investments. As a result, developed market equities fell

about 1.3% during this phase. The longest U.S.

government shutdown in history — lasting 43 days —

ended in mid-November. However, it left behind

uncertainty regarding economic data flow, growth

projections, and potential Federal Reserve decisions.

These concerns led to flat global equity returns for the

month, with developed markets posting gains of just

0.3%. Investors rotated into defensive sectors such as

healthcare and consumer staples. Adding to the

pressure, China’s October trade data revealed a decline in

exports, heightening concerns over weak global demand

and insufficient stimulus measures. This weighed on

commodity prices and emerging markets that are closely

tied to Chinese demand. Geopolitical tensions also

persisted, along with falling energy prices and a

strengthening U.S. dollar. These factors increased

safe-haven demand, easing U.S. Treasury yields but

weakening emerging market currencies. Fiscal

uncertainties—especially UK budget issues and

concerns over U.S. tariffs—further unsettled global bond

and equity markets toward the end of the month.

Despite global headwinds, India showed strong

macroeconomic resilience. Q2 GDP growth surprised on

the upside, coming in at 8.2%, significantly above

expectations. This boosted investor confidence,

especially in sectors such as financials and information

technology. Strong corporate earnings, including major

deals such as TCS’s SAP contract, reinforced positive

sentiment. Mid-cap and small-cap companies posted

profit-after-tax growth of 27–37% year-on-year, adding to

the optimism in the broader market. Another key support

factor was the indication by the Reserve Bank of India of

a possible interest rate cut. With October CPI inflation at

just 0.3%, expectations grew of a policy rate reduction to

around 5.25% in December. This outlook benefited

interest-rate sensitive sectors like banking and

automobiles and supported the broader indices’ gains.

In conclusion, November 2025 reflected a delicate

balance between global uncertainty and domestic

strength. Although FIIs withdrew capital from Indian

equities and international markets remained volatile due

to technology corrections, geopolitical issues, and weak

trade data from China, the Indian market held firm.

Strong GDP growth, RBI’s accommodative signals, robust

corporate earnings, and record domestic inflows

ensured that both Nifty and Sensex closed the month in

positive territory. By early December, the Sensex had

even extended its gains, reaching 85,712 and reflecting a

2.88% upward movement into the new period. This

underlined India’s relative resilience in a challenging

global environment.