Equity inflows fell 19% MoM to ₹24,690 crore in October

but rebounded late November with Nifty's 1.87% gain;

AUM approached ₹80 trillion, folios hit 23.8 crore, and

gold/silver ETFs recorded YTD ₹276bn inflows. Top

schemes like Nippon India Large Cap (9.88% 1Y)

outperformed amid FII. Funds pivoted to ultra-short debt

amid RBI rate uncertainty and fiscal deficit at 52.6% of

target, cutting long-duration bets as yields stayed above

6.5%.

SEBI proposed eliminating the additional 5 bps charge on

schemes (transitory exit load offset, reduced from 2018),

rationalizing TER definitions excluding statutory levies,

and capping brokerage to enhance unitholder costs.

Reforms tightened fund overlaps (value/contra ≤50%

portfolio), mandated 75% equity in equity funds (up from

65%), permitted sectoral debt schemes (≤60% overlap),

and

expanded

REITs/InvITs/residuals.

hybrids/arbitrage

New

AMC

framework

emphasized digital disclosures, 30-day rebalancing for

passive deviations, up to 6 goal-based target date funds

(3/5/10Y lock-ins), and stricter replication rules.

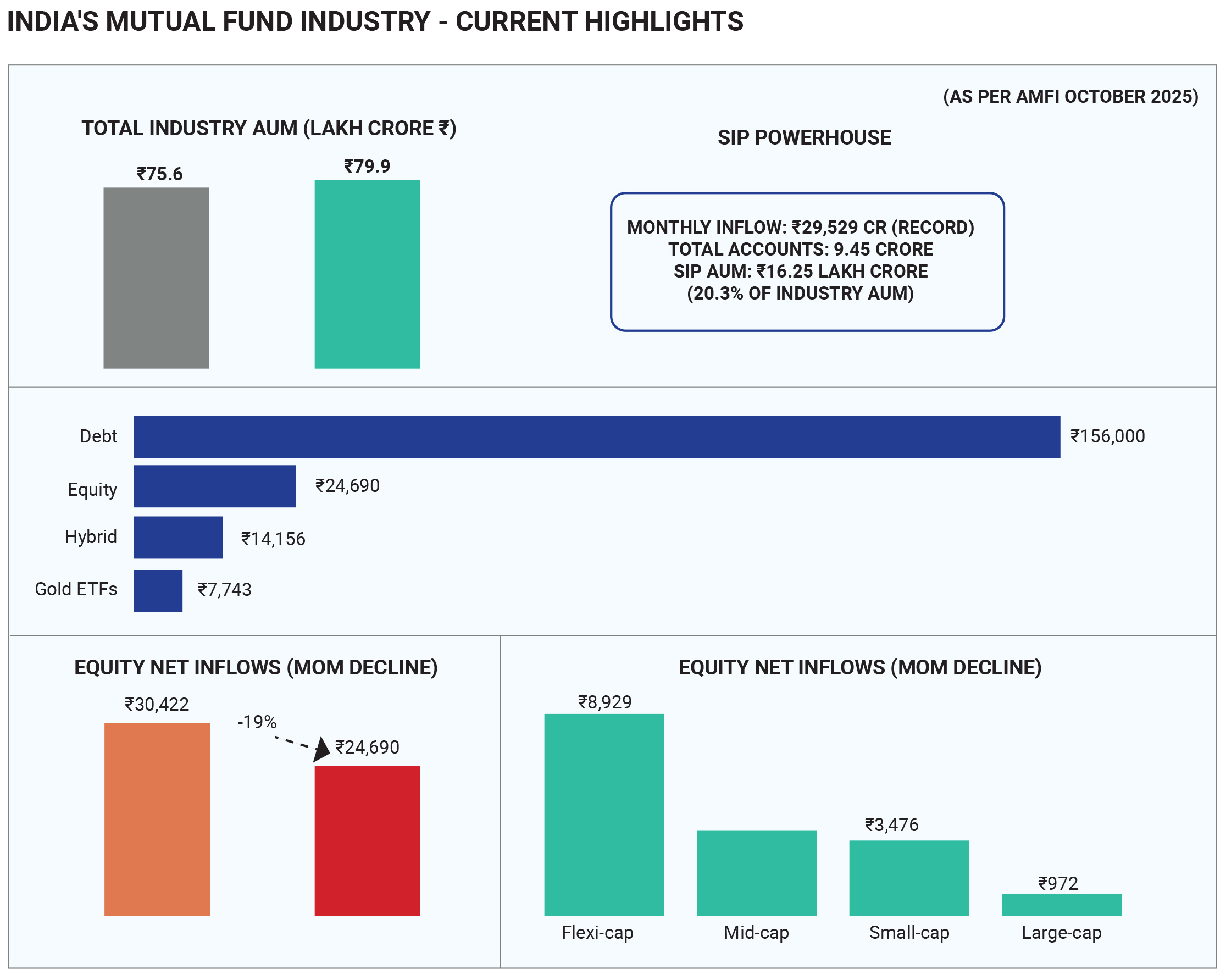

India’s mutual fund industry AUM reached a record ₹79.9

lakh crore (up from ₹75.6 lakh crore in September),

propelled by mark-to-market gains and robust retail

participation

despite

moderated equity inflows.

Equity-oriented schemes attracted ₹24,690 crore net

inflows—the 56th consecutive positive month—but

declined 19% MoM from ₹30,422 crore, signalling caution

amid volatility; flexi-cap led at ₹8,929 crore, while

large-cap fell to ₹972 crore, mid-cap dropped 25% to

₹3,807 crore, and small-cap eased 20% to ₹3,476 crore.

Debt funds surged with ₹1.56 lakh crore inflows, hybrids

added ₹14,156 crore (arbitrage ₹6,920 crore dominant),

and gold ETFs shone at ₹7,743 crore, reflecting

safe-haven shifts. SIPs hit a second straight record at

₹29,529 crore (+0.57% MoM) from 9.45 crore accounts,

with AUM at ₹16.25 lakh crore (20.3% of industry total).

New fund offers (18 open-ended schemes) mobilized

₹6,062 crore, including ₹4,173 crore from equity; folios

rose to 25.6 crore. Four Specialized Investment Funds

(SIFs) debuted, garnering ₹2,005 crore AUM by

month-end. Overall, growth underscored SIP resilience

and diversification amid FII outflows.

After December 5th , RBI’s 25 bps repo rate cut to 5.25%

(125 bps in 2025) signals continued monetary easing

amid low inflation, strengthening investor confidence.

target, cutting long-duration bets as yields stayed above

6.5%.

SEBI proposed eliminating the additional 5 bps charge

on schemes (transitory exit load offset, reduced from

2018), rationalizing TER definitions excluding statutory

levies, and capping brokerage to enhance unitholder

costs. Reforms tightened fund overlaps (value/contra ≤

50% portfolio), mandated 75% equity in equity funds (up

from 65%), permitted sectoral debt schemes (≤60%

overlap), and expanded hybrids/arbitrage to

REITs/InvITs/residuals.

New

AMC

framework

emphasized digital disclosures, 30-day rebalancing for

passive deviations, up to 6 goal-based target date funds

(3/5/10Y lock-ins), and stricter replication rules.

India’s mutual fund industry AUM reached a record ₹79.9

lakh crore (up from ₹75.6 lakh crore in September),

to

propelled by mark-to-market gains and robust retail

participation

despite

moderated equity inflows.

Equity-oriented schemes attracted ₹24,690 crore net

inflows—the 56th consecutive positive month—but

declined 19% MoM from ₹30,422 crore, signalling

caution amid volatility; flexi-cap led at ₹8,929 crore, while

large-cap fell to ₹972 crore, mid-cap dropped 25% to

₹3,807 crore, and small-cap eased 20% to ₹3,476 crore.

Debt funds surged with ₹1.56 lakh crore inflows, hybrids

added ₹14,156 crore (arbitrage ₹6,920 crore dominant),

and gold ETFs shone at ₹7,743 crore, reflecting

safe-haven shifts. SIPs hit a second straight record at

₹29,529 crore (+0.57% MoM) from 9.45 crore accounts,

with AUM at ₹16.25 lakh crore (20.3% of industry total).

New fund offers (18 open-ended schemes) mobilized

₹6,062 crore, including ₹4,173 crore from equity; folios

rose to 25.6 crore. Four Specialized Investment Funds

(SIFs) debuted, garnering ₹2,005 crore AUM by

month-end. Overall, growth underscored SIP resilience

and diversification amid FII outflows.

After December 5th , RBI’s 25 bps repo rate cut to 5.25%

(125 bps in 2025) signals continued monetary easing

amid low inflation, strengthening investor confidence.

SIPs remain resilient at a record ₹29,529 crore from 9.45

crore accounts and may exceed ₹30,000 crore in

December, supported by 7.3% GDP growth. Lower

borrowing costs are boosting banking, auto, and realty

stocks, improving long-term equity returns despite FPI

outflows, which DIIs continue to absorb. Debt funds may

see strong inflows as yields soften, while hybrid funds

and gold ETFs retain appeal. Overall mutual fund AUM

could cross ₹82 trillion by month-end.