With markets rallying through June 2023, it touched

all-time highs thrice in a month. As on 1st June 23 Nifty

50 opened at 18579 by the end of the month it crossed

the 19300 mark. Sensex too opened at 62736 points and

ended at 64386 by the end of June 23. The major factor

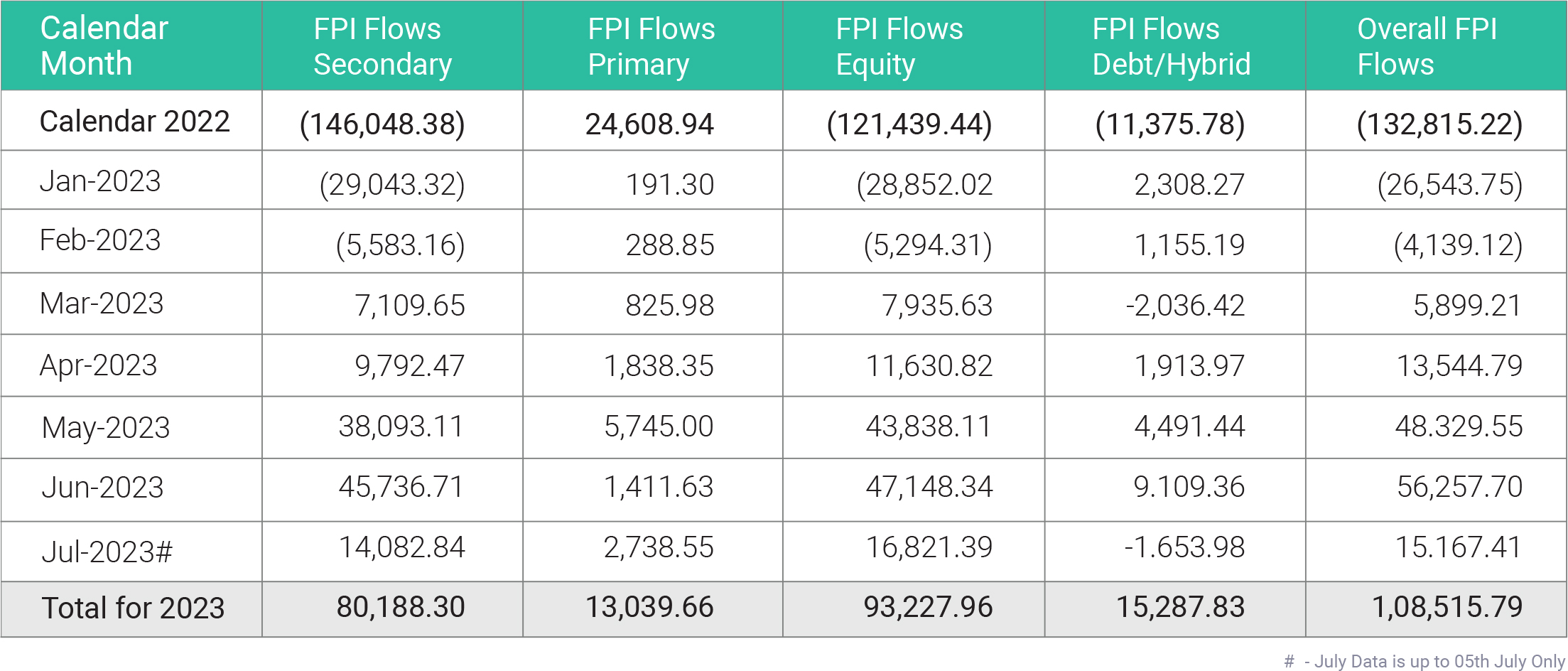

which has fuelled the markets are the strong inflows

from Foreign Institutional investors (FIIs). The mix of

several factors has attracted them, firstly the current

account deficit of March 23 quarter at about 0.2% of GDP,

which is much lower than estimates of 4% of GDP.

Secondly the US GDP stands at much higher than expected for first quarter at 2%, which is 70 bps over second

estimate, which indicates the recession fears are being

denied largely. Thirdly the merger of HDFC Ltd. and HDFC

Bank created excitement in the Indian BFSI sector as well

as buying in possible index inclusions. The last and most

important factor is the stable rupee and positive real

interest rates which uplifts FPIs inflows into equity and

debt too.

The robust corporate earnings results have helped

markets in the June quarter, the sectors which gained

remarkably are banks, non-banking lenders, oil & producers and FMCG. Also, the favourable inflation numbers

aided the markets to gain, India's consumer price index

(CPI) inflation fell to 4.25% in May hitting a 25-month low.

This was a significant drop in retail inflation as it was

4.7% in April 2023 and 7.04% in May 2022. The upper

tolerance limit of 6% by Reserve Bank of India for three

consecutive months. With the advancement of monsoon

across.India and also the IMD prediction for normal monsoon for this year, which assure the low food inflation

and good economic numbers which would affect few

sectors like banking, auto, FMCG and agro based sectors

in coming months .

The international factors would be uncertain for the

markets with the ambiguity over US economy and other

world economies struggling to curb the inflation. The

Ukraine war is still on which is being closely monitored by

the world. The global markets have also ended in the

positive. In the last week of June, strong economic data

releases in the US showed that the economy is resilient,

while the inflation is cooling. The ease in inflation data in

Europe and the stimulus hope from Beijing to boost the

Chinese economy also weighed on the market sentiments. Also, the US fed indicates two more rate hikes in

the current year are expected.

The oil price is expected to surge with Saudi Arabia’s cut

production by 1 million barrel per day starting from July

2. OPEC decided to reduce overall production targets

from 2024 by further total of 1.4 million bpd. The US rate

hikes also affects the global crude prices, as the strong

dollar makes oil costlier for other currency holders.

Indian stock markets are expected to move in positive

territory on the back of good monsoon, continuous

positive economic numbers, commendable corporate

results, FIIs inflows, increasing DIIs (domestic institutional investors) and vigilant watch by regulators on the

economic conditions of the country.