As prices soar, the major world economies are trying to

find a way to tackle them. Across the world the people

feel the brunt of hefty prices for the things they buy every

day. Covid has disturbed the world economies and now

the policy makers are struggling to balance out its

effects.

The uncertainty to curb the inflation could result in destabilize the period of spiralling prices. Higher inflation

would squeeze the people and businesses making future

unpredictable for them. Too aggressive approach of

policy makers could lead to crumpling global economy.

This could lead to the major recession, shutting down

businesses and increasing unemployment. So, the

policymakers are taking precautionary steps to bring

down the inflation across the world.

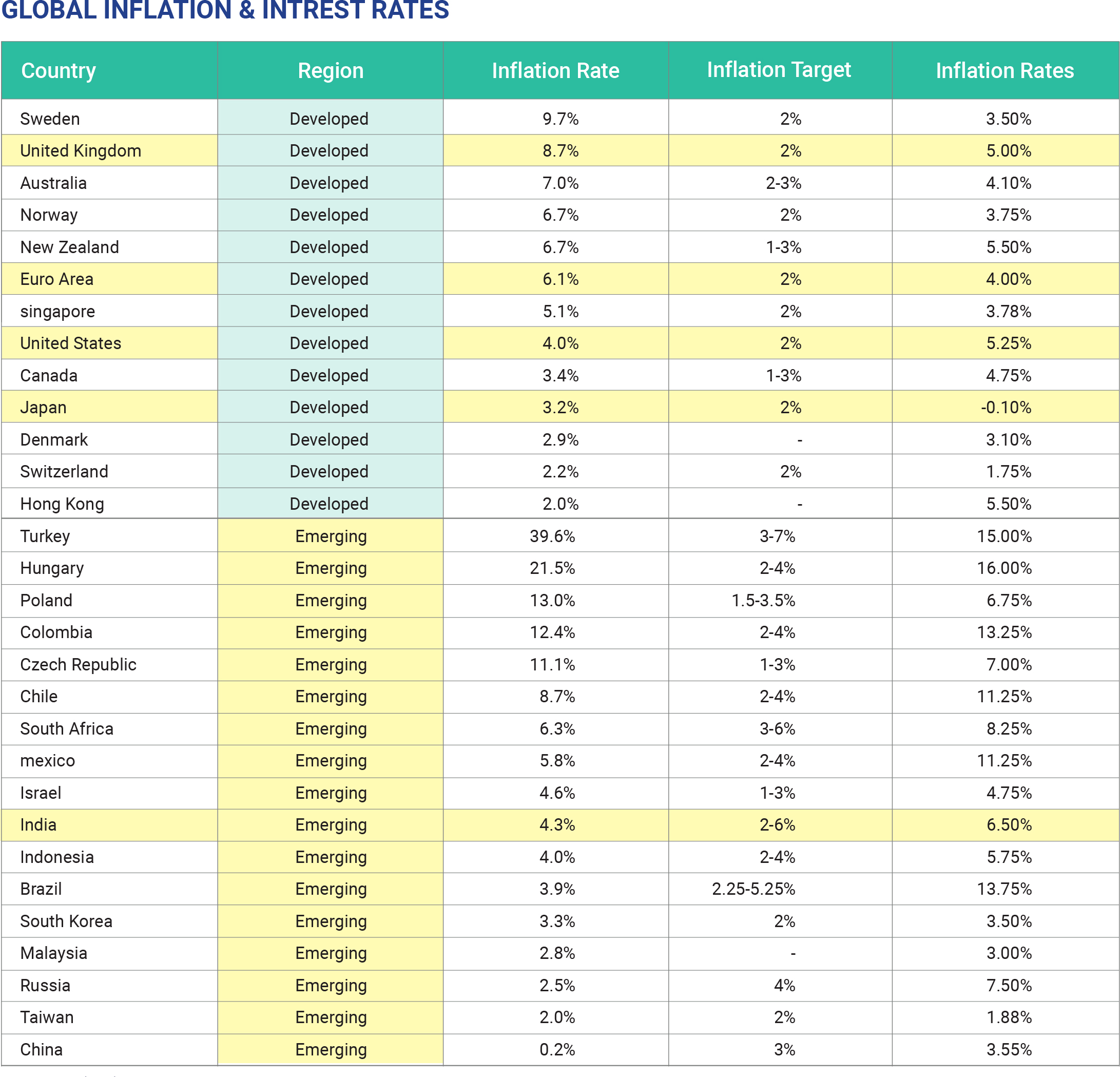

Few leaders of major central banks in North America,

Europe and others have recently stated that they would

continue raising the rates as inflation is moderate and

remain well above their target rates that is 2%. U.S.

Federal Reserve have raised their policy rate to just above

5% from near zero in March 2022, and they forecast

raising it two more times in 2023, to just above 5.5%.

Policymakers at the European Central Bank, which sets

policy for the 20 countries that use the euro, also expect

to continue raising rates, which have reached the highest

level since 2001. The Bank of England recently surprised

investors by raising rates more than expected with its

13th consecutive increase. In a recent report, its stated

that quite a few Asian countries are expected to cut interest rates ahead of the US Fed, starting in the end of 2023

to support demand recoveries into 2024. Despite a

500-bps rate hike by the US Fed from March 2022, much

of the US economy has remained strong.

The recent report by Asian research company, stated that

the growth is supported by government spending on new

industry programs and strong growth in decarbonisation

industries. As a result, core inflation in May of 5.3%

on-year is now above headline inflation (4.1%). Further, it

stated that going by historical evidence, unless the US

Fed pushes core inflation down towards 2 per cent by

rate hikes, inflation may well spiral up. For Europe the

region is not as buoyant as the US and is doing better

than expected, while maintaining that the European

Central Bank (ECB) will persist with rate hikes in H2 2023

before switching to a string of rate cuts in 2024, possibly

ahead of the US Fed. Since the ECB’s team expects GDP

growth to slow to 0.9% this year (from 3.5% in 2022)

followed by a lift to 1.5% in 2024 while inflation slows

from 5.4% to 3.0%. The report has lifted its 2023 GDP

forecast for India to 5.8% from 5.4% while nudging 2024

to 6.2% from 6%. It said that the inflation and interest rate

headwinds should ease into 2024 with increase in

consumer demands and manufacturing growth.

In the month of June ‘23, world's major central banks

delivered the biggest number of monthly interest rate

hikes, surprising markets and flagging more tightening

ahead as policy makers struggle to fight the inflation.

According to the Reuters data, seven out of the nine

central banks with 10 most heavily traded currencies

done rate hike in June while two opted for no change.