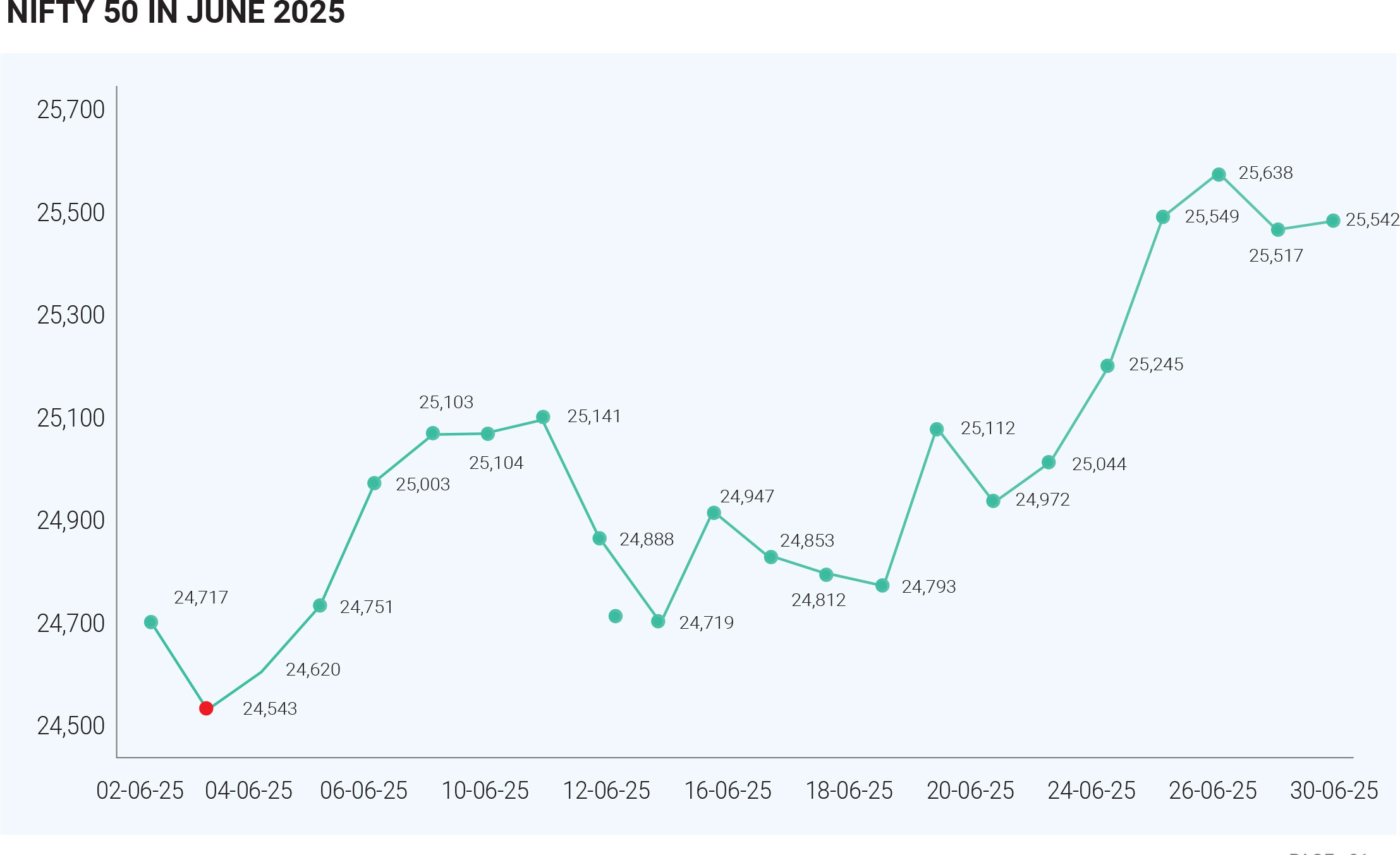

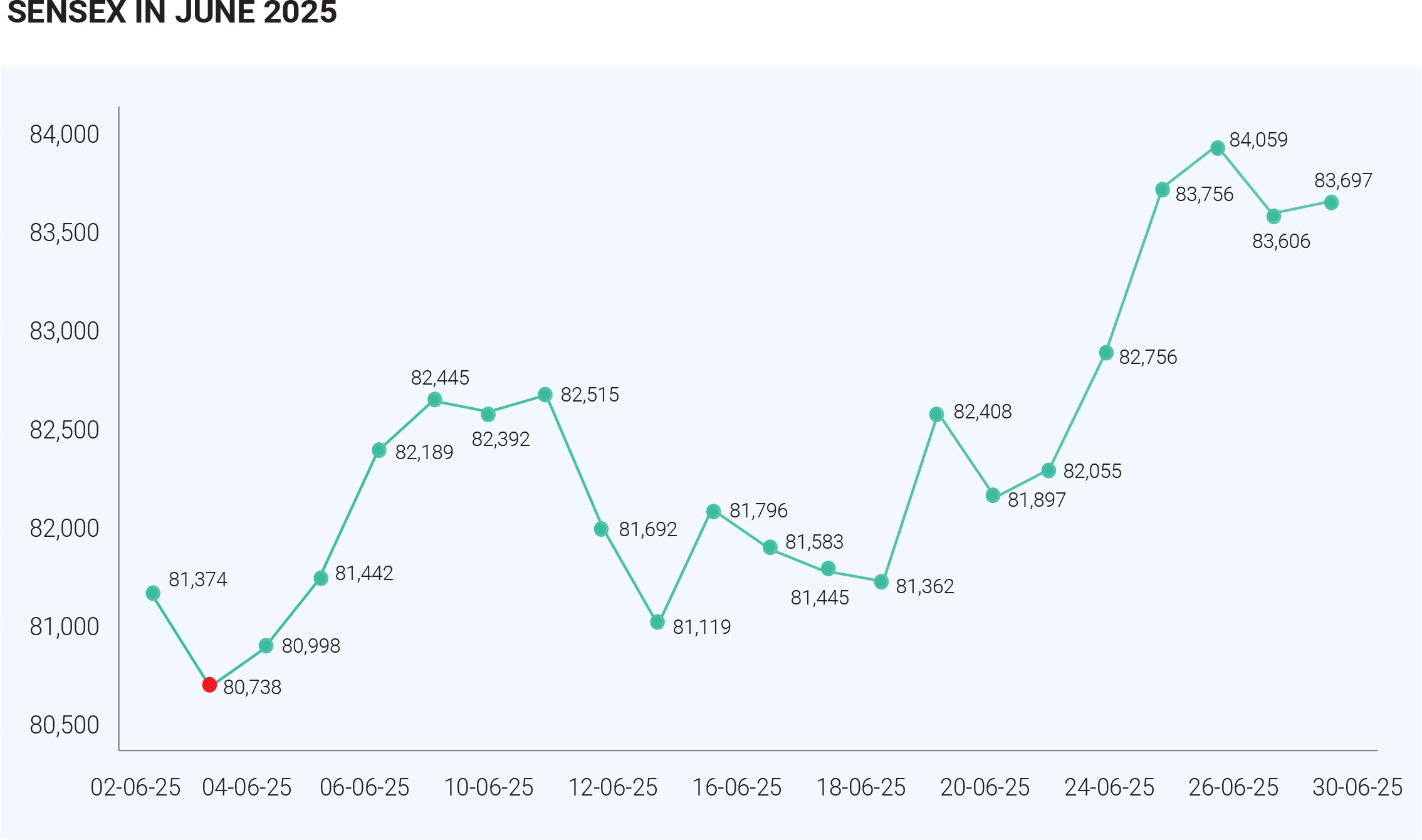

June 2025 was a pivotal and eventful month for Indian equity markets, with the Sensex and Nifty registering impressive gains of 2.65% and 3.1% respectively, despite being tested by intense geopolitical uncertainty, sectoral shifts, and sharp fluctuations in investor sentiment. The first half of the month was defined by heightened global tensions as conflict between Iran and Israel threatened to escalate into a broader crisis, with Iran’s threat to block the Strait of Hormuz sending oil prices surging and sparking a wave of panic selling across global equity markets. Safe-haven assets like gold and the U.S. dollar spiked, while Indian indices retreated sharply dragged down by crude sensitivity and global risk aversion.

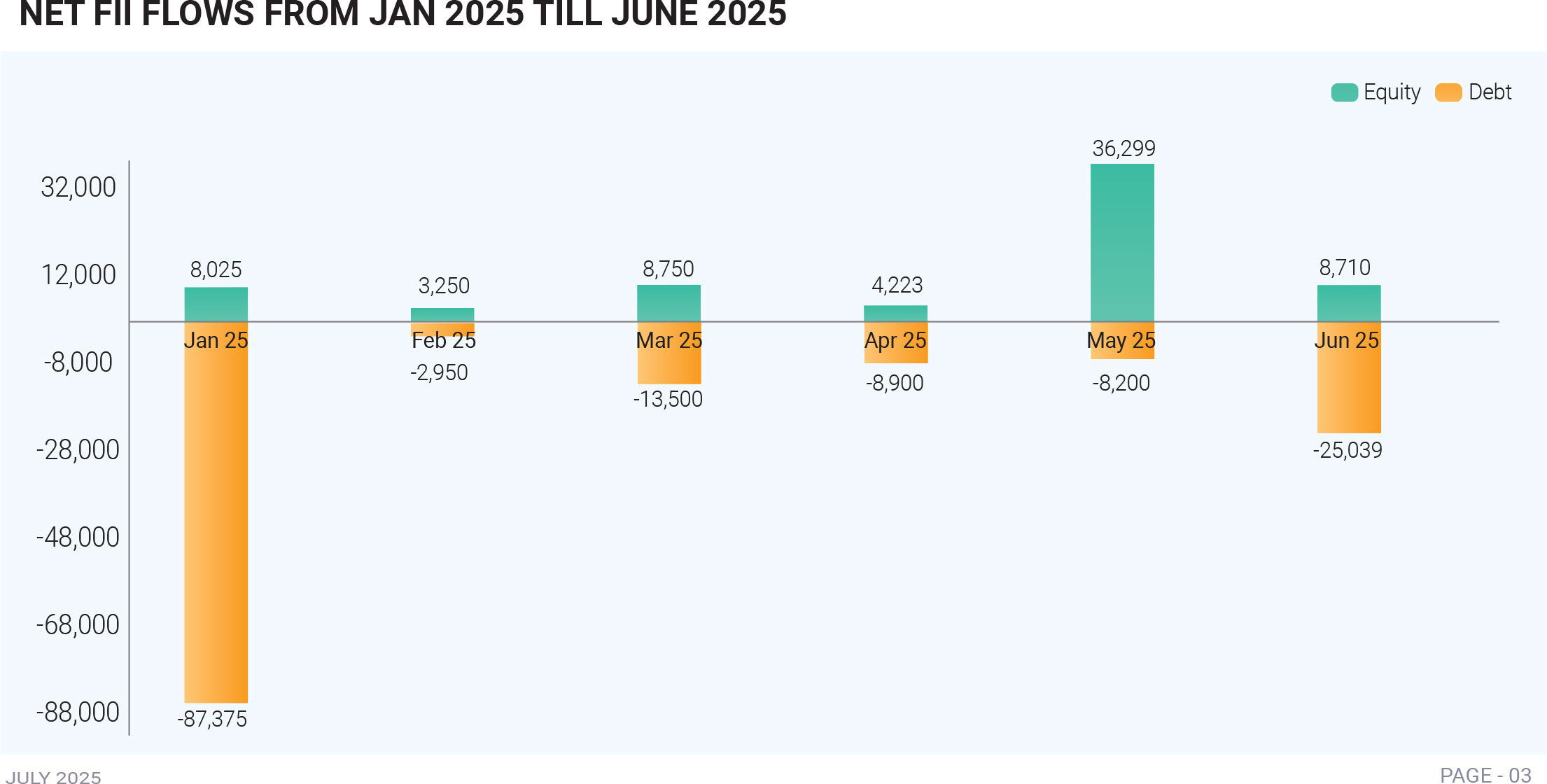

IT stocks, including bluechips suffered the most as fears of soft global tech demand took hold, and the Sensex slumped to an intraday low of 81,476.76 on June 23, while the Nifty dipped to 24,824.85. However, the markets staged a remarkable turnaround following a mid-month ceasefire announcement between Iran and Israel, which dramatically improved risk sentiment and reignited optimism. This geopolitical easing, coupled with falling crude oil prices and a weakening U.S. dollar, made Indian equities attractive again to foreign investors, sparking renewed Foreign Institutional Investor (FII) inflows that fuelled a powerful second-half rally. The Sensex rebounded 700 points on June 25 to close at 82,756, while the Nifty crossed the 25,200 mark for the first time in 2025. For sector performance, the rally was led by private financials, PSU banks, infrastructure, IT, and defence-linked stocks, with midcap and smallcap segments outperforming large caps. The Nifty Smallcap 100 index surged 6.66%, reflecting the market’s growing appetite for high-risk, high-reward investments. This shift in risk appetite also indicated a broad-based rally driven by strong domestic retail participation, mutual fund SIP inflows, and a sustained bull run in broader markets. Notably, defence and shipbuilding stocks rallied strongly due to increased government spending and a clear policy push, while sectors like FMCG and Realty lagged as investors rotated out of defensive plays into growth sectors. However, despite the upbeat mood, the month was not without headwinds. A surge in equity supply through IPOs and large block deals in the second half of June tested market liquidity, absorbing investor funds and leading to intermittent consolidation and profit booking, especially in overbought counters. The final trading session on June 30 saw mild correction: the Sensex dropped 452 points to close at 83,606.46 and the Nifty lost 120 points to end at 25,517.05, snapping a four-day rally. Still, broader indices like the BSE Midcap and Smallcap held firm, reflecting continued confidence in India’s long-term growth story. The rotation out of defensive sectors was largely strategic—FMCG, for example, underperformed due to persistent margin pressures and concerns over volume growth, particularly in rural markets. Meanwhile, Auto and PSU banks enjoyed renewed investor interest on the back of robust credit growth, improved NPAs, and strong policy support. Retail investor participation remained high despite foreign volatility, helping absorb FII outflows in early June and providing stability to the market during its more volatile phases. From a macroeconomic perspective, the Indian economy remained resilient with stable inflation, upbeat industrial production numbers, and healthy credit growth—especially in retail and MSME segments—underpinning investor optimism. Additionally, positive developments such as USFDA approvals in the pharma space and robust quarterly updates from select companies gave a further boost to individual stocks and sectoral indices. Technically, the markets displayed a classic recovery, with sentiment swinging from bearishness in the first half of June to a renewed bull run in the latter part, driven by easing geopolitical risks and improving global macro indicators. Notably, foreign flows turned positive after June 20, with sustained buying in banks, energy, and infrastructure counters. As the month ended, investors were left balancing optimism with caution. On one hand, domestic fundamentals, liquidity, and earnings resilience provided a strong foundation; on the other, the rush of IPOs, the possibility of global rate actions, and ongoing geopolitical fragility posed potential risks. For investors, June was a reminder that markets are no longer just indicators of economic performance—they are real-time barometers of sentiment, reacting swiftly to headlines, policy shifts, and capital flows. Sector rotation was another key theme, with the market moving decisively from defensives like FMCG into cyclical and policy-driven sectors such as infrastructure, public sector enterprises, and defence, reflecting confidence in India's capital expenditure cycle and fiscal discipline. In conclusion, June 2025 showcased the complexity and resilience of Indian equity markets. It was a month marked by sharp corrections and equally sharp recoveries, by cautious optimism and bold sectoral bets. Despite initial volatility triggered by geopolitical unrest, the underlying strength of the domestic economy, combined with favourable global cues, drove a strong rally in the second half. With the Sensex and Nifty ending the month on a high note and broader indices outperforming, the market demonstrated its ability to absorb shocks, recalibrate quickly, and reward quality amid uncertainty. As the second half of the year begins, the key message for investors is to stay agile, keep quality at the core, and be prepared for episodic volatility—because the markets, as June 2025 proved, are sentiment machines first and foremost, finely tuned to every global whisper and domestic signal.