Topic 1: MPC REPO RATE: A MYSTERY BOX

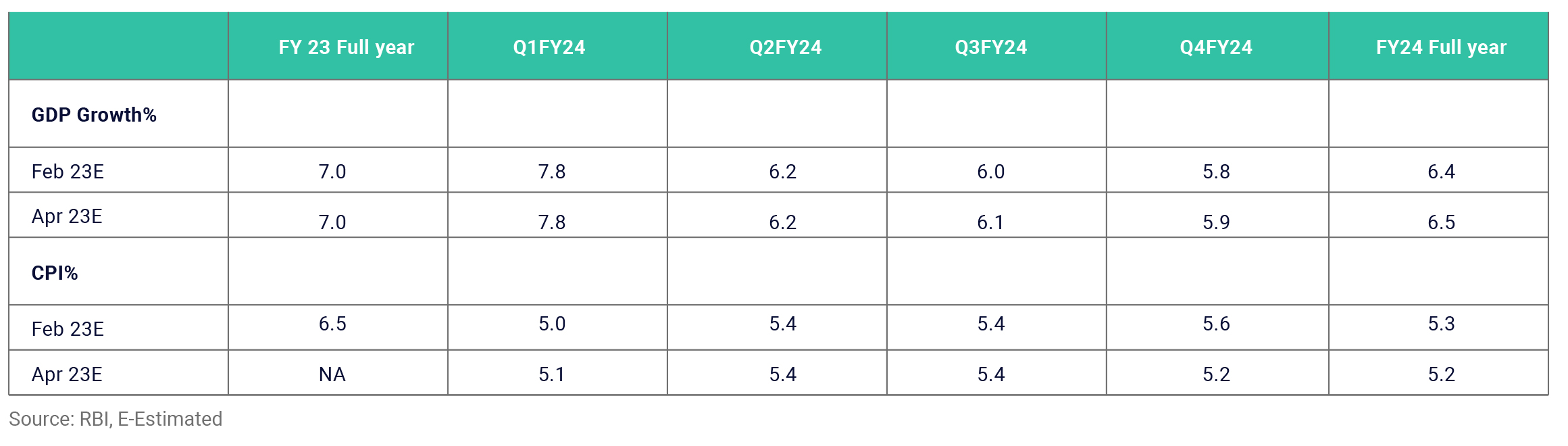

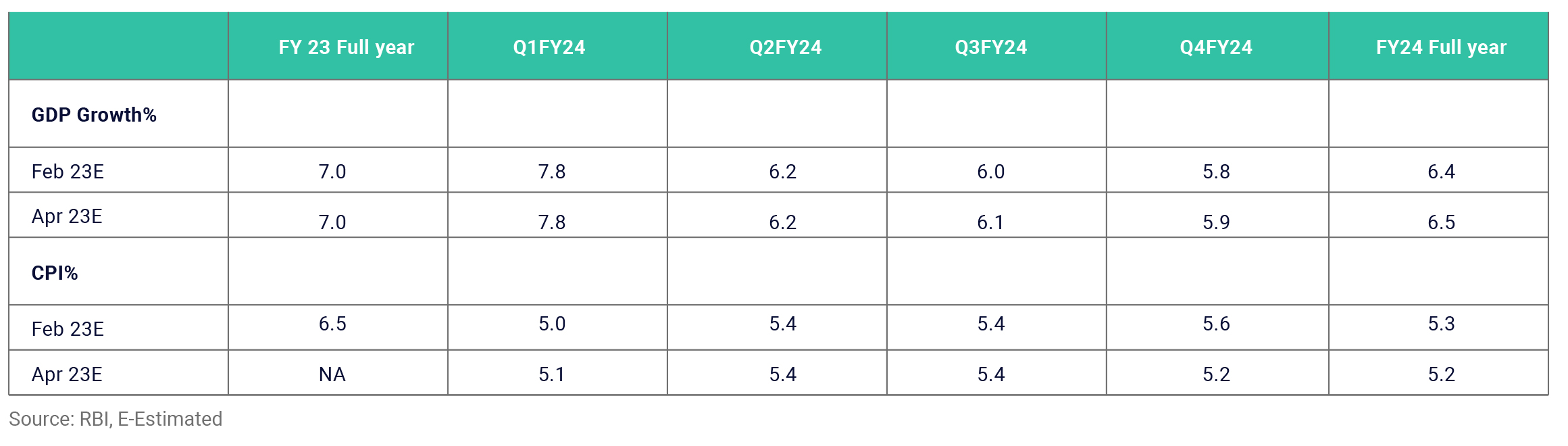

On 6th April 2023, MPC in its first Bi-monthly meeting monetary policy

review for FY2024, takes the U-turn from hike in repo rate, it was kept

unchanged at 6.50%. It was a mystery pause after the six consecutive of

continuous rate hikes. The RBI lowered its inflation projection for FY24 to

5.2% from 5.3% in its Feb2023 policy. Real GDP growth for FY24 is

projected at 6.5%. According to MPC's latest policy meeting minutes,

MPC would prefer to observe how past rate moves have affected inflation

and wait until there has been some easing in order to justify a general

pause in policy rates. The main focus of the MPC meeting, analysing the

risks associated with the inflation predictions, anticipating the rate cycle

would take some time to reverse. The International Monetary Fund (IMF)

revised its current fiscal year GDP prediction for India downward by 20

basis points to 5.9% and FY25 to 6.3%. Even though India's economy is

still one of the fastest growing in the world. Moreover, the MPC has also

kept the door open to reverse its stance in the next meeting, if necessary

to curb the inflation numbers. RBI’s Central board is keeping a close

watch on the global and domestic economic situation, as well as the

associated challenges, including the impact of current global geopolitical

developments