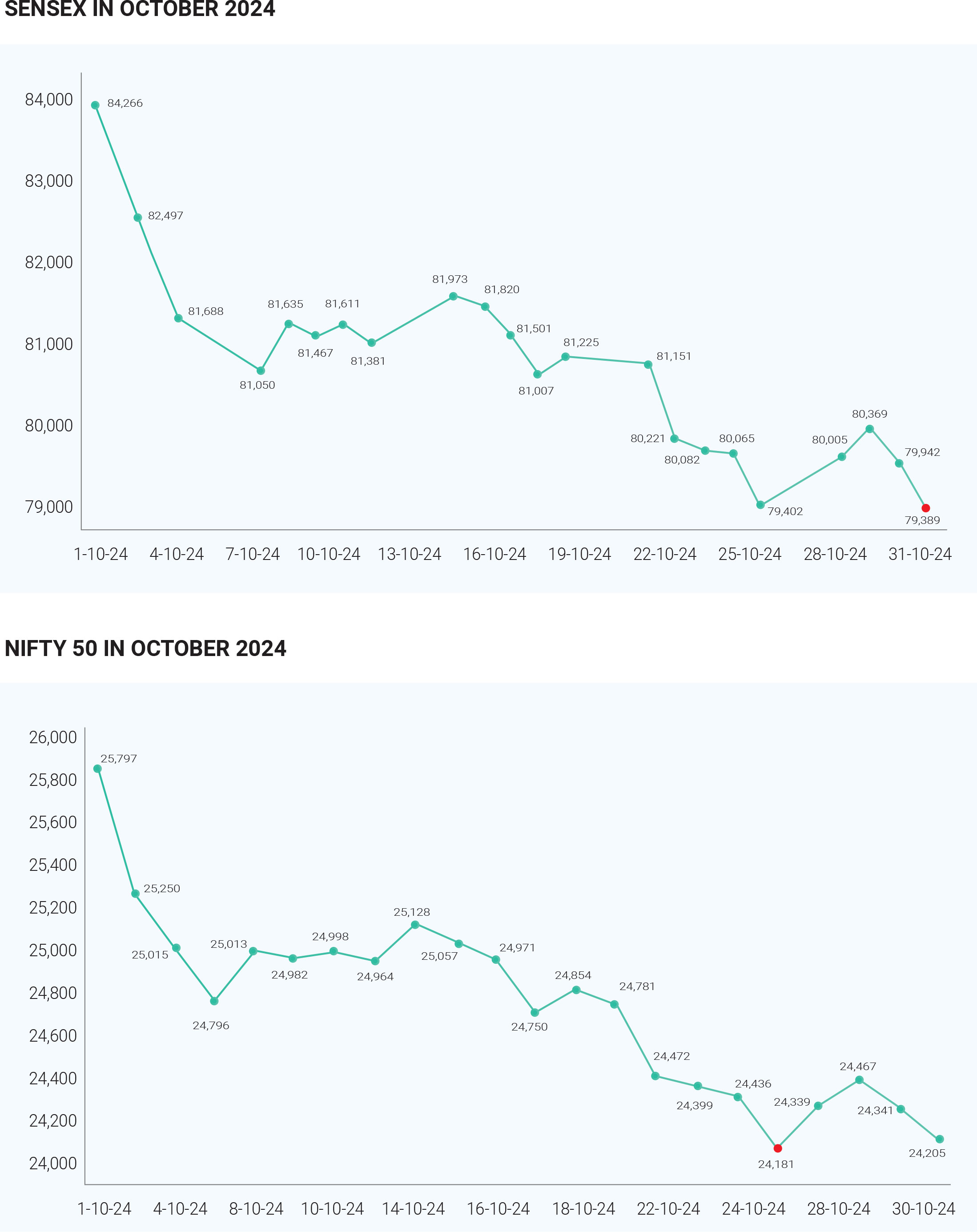

The Nifty 50 closed October 2024 with a substantial decline of 6.2%, marking its worst monthly performance since the COVID-19 pandemic in March 2020. This downturn outpaced the Sensex, which fell by 5.83%. Several factors, including record selling by Foreign Institutional Investors, slower-than-expected corporate earnings, and a potential correction due to overvaluation, contributed to this significant market correction. Markets slipped in the first week of the month Sensex plummeted by 1730 points around 2.05% to close at 82536 whereas Nifty decline by 530 points closing down at 25267. The market took a dramatic plunge, plummeting under the weight of heightened geopolitical tensions in West Asia and the impact of new regulatory measures from SEBI on futures and options trading. The initial crash was just the beginning. The indices continued their downward spiral, battered by relentless selling from foreign institutional investors (FIIs), who had offloaded a staggering ₹93,000 crore in equities by mid-October. The situation worsened with disappointing corporate earnings reports, especially from giants like Hindustan Unilever, further denting investor confidence. On October 28th, a glimmer of hope emerged as the Sensex surged nearly 900 points, closing at a respectable 80,005, while the Nifty climbed to around 24,339. This rally was fuelled by gains in banking and metal stocks, signalling a temporary reprieve amidst the prevailing market anxieties. In turbulent month of October 2024 various sectors, including banking, FMCG, automobiles, gas and energy, chemicals, telecommunications, and retail, witnessed significant declines. IndusInd Bank faced the steepest decline, with its share price dropping by 28.3%, from ₹1,448 to ₹1,038.25. The decline was driven by a 40% drop in net profit for the September quarter, raising concerns about its growth prospects and leading to heavy selling pressure. Other banks also experienced declines due to overall negative sentiment in the financial sector, exacerbated by FII selling. Bajaj Auto saw their stock prices decrease by 20.2%, reflecting broader concerns about consumer demand and economic slowdown affecting vehicle sales. Indraprastha Gas experienced a significant drop of 25.3% in its share price during October, reflecting investor anxiety over future earnings amid rising input costs and regulatory challenges in the energy sector. Retailers such as Avenue Supermarts (D-Mart) reported a 22.2% loss in share value, attributed to fears of reduced consumer spending during the festive season combined with rising operational costs.

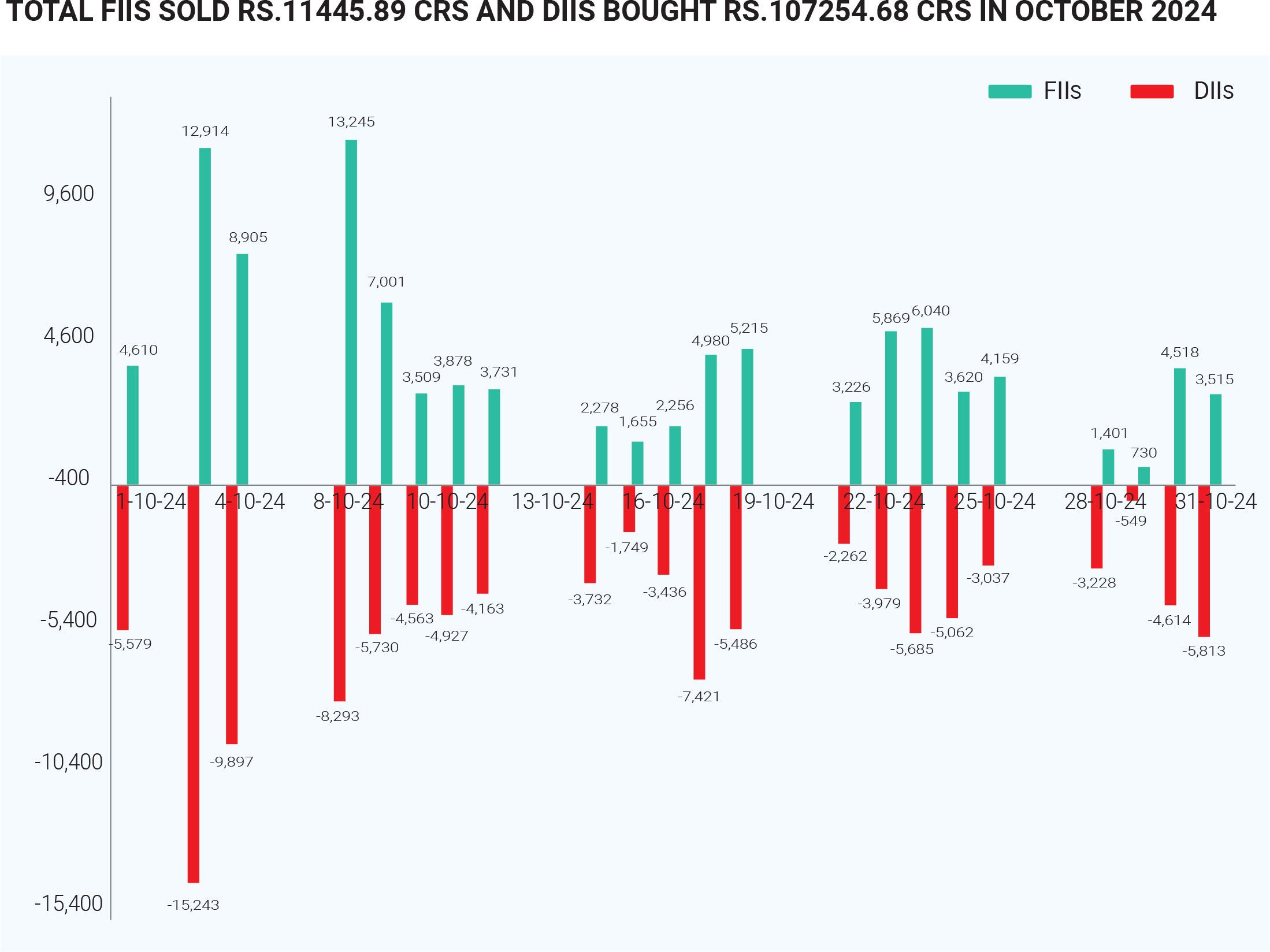

The unprecedented exit by foreign institutional investors (FIIs) was a major catalyst for the market's decline. As investors sought greener pastures in markets like China, where valuations were perceived as more attractive, a relentless wave of selling engulfed Indian equities, casting a long shadow over the month. The contrasting activities of FIIs and DIIs in October 2024 highlight a significant divergence in market sentiment. While FIIs engaged in record sell-offs driven by geopolitical concerns and a shift towards cheaper markets like China, DIIs capitalized on these market conditions by increasing their investments significantly. This dynamic created a tug-of-war effect in the Indian equity markets, with DII buying providing some level of support against the backdrop of substantial FII outflows. FIIs offloaded equities worth approximately ₹85,000 crore (around $11 billion) during the month. This marked one of the highest monthly sell-offs recorded, surpassing previous significant sell-offs during market disruptions, such as in March 2020 due to the COVID-19 pandemic. DIIs made substantial net investments of approximately ₹98,400 crore in October, marking their highest monthly purchasing activity on record. This influx was primarily driven by mutual funds and insurance companies.

Navigating through the turbulent November 2024, investors should steer their focus towards sectors exhibiting resilience, such as banking and metals. Defensive stocks can provide a safe harbour during these volatile times. Mid-cap opportunities may offer potential for growth, but diversification remains paramount to weather the storm. Staying abreast of global cues like ongoing conflict in West Asia also the US elections, and domestic economic policies will be crucial in crafting effective investment strategies during this challenging period