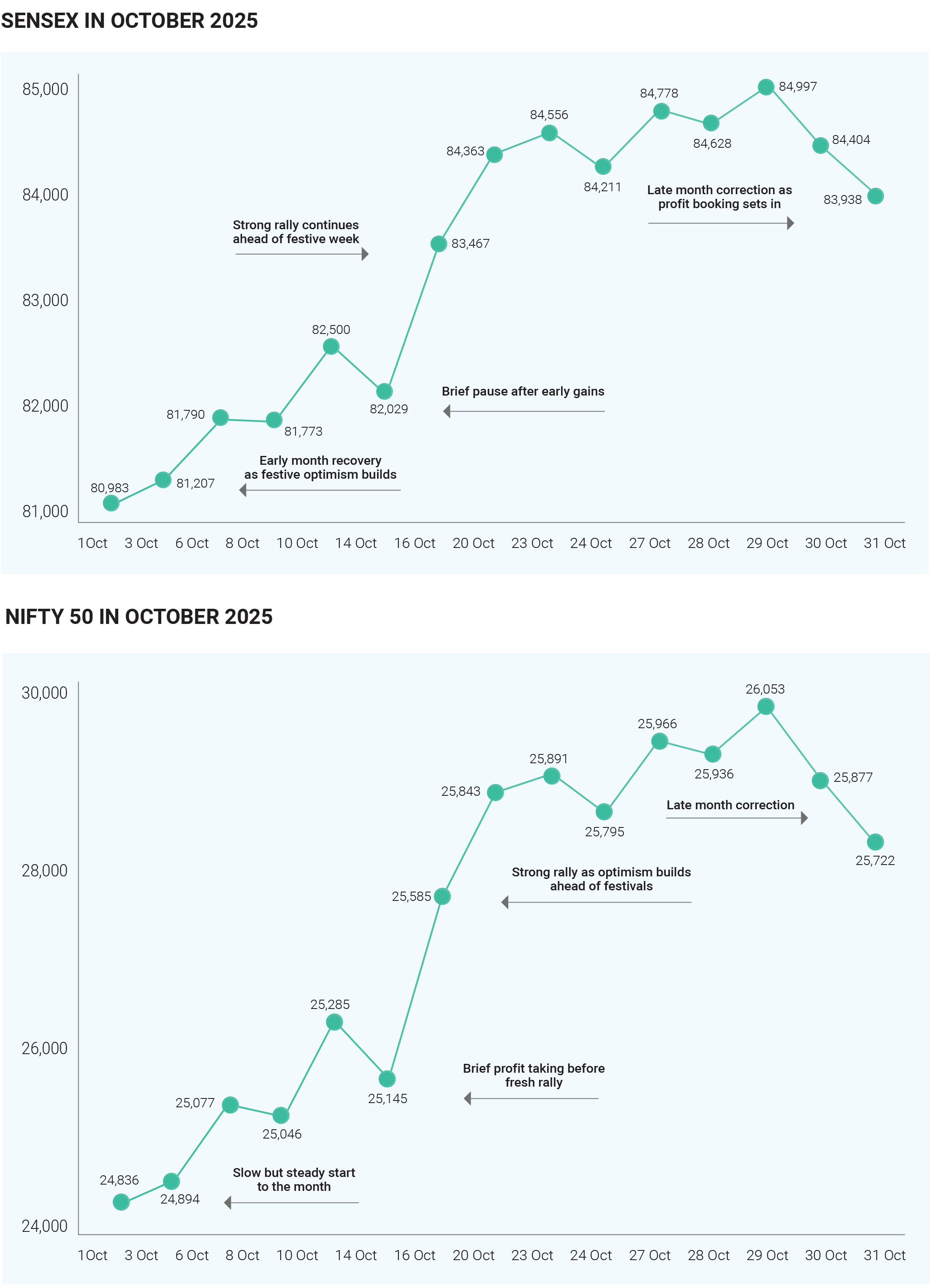

In October 2025, Indian equity markets demonstrated

remarkable resilience and strength, with both the Sensex

and Nifty registering strong monthly gains despite

closing the month on a slightly weaker note. The

market’s trajectory was defined by alternating phases of

optimism and caution—early enthusiasm fuelled by

robust corporate earnings and sustained foreign inflows

drove benchmarks to record highs, but profit-booking

and global headwinds toward the month’s end triggered a

mild pullback. This dual-phase performance captured the

complex balance between domestic growth optimism

and external vulnerabilities as investors navigated an

environment shaped by earnings momentum, regulatory

changes,

and

volatile

international

By October 31, 2025, the Sensex settled at 83,938.71,

down 0.55% for the day, while the Nifty closed at

25,722.10, slipping 0.60%. Despite these end-of-month

declines, both indices recorded impressive monthly

advances of nearly 5%—their best performance since

March 2025. The rally was largely fuelled by strong Q2

FY26 earnings and steady foreign portfolio inflows,

particularly into technology, public sector banking, and

telecom stocks such as Bharti Airtel, which touched

record highs during the period. Midcap and small-cap

segments also participated enthusiastically, signalling

broad-based investor confidence. However, the market’s

upward momentum moderated in the final week as

investors opted to lock in profits after sustained gains.

Banking and financial stocks came under notable

pressure following regulatory changes announced by

SEBI that affected Bank Nifty derivatives. Major private

lenders like HDFC Bank and ICICI Bank witnessed heavy

profit-taking, contributing to the overall market’s

weakness. Meanwhile, defensive segments such as

healthcare, pharmaceuticals, and metals also faced mild

declines, as investors rotated capital toward cyclical and

growth-oriented sectors during the earlier bullish stretch.

The Sensex and Nifty’s performance throughout the

month followed a clear pattern—strong early gains driven

by robust buying in IT and banking counters, followed by

a corrective phase triggered by global caution and

sectoral profit-booking. Despite the late weakness, PSU

banks and oil & gas companies provided crucial support,

helping markets sustain their monthly gains.

Global developments exerted significant influence on

market sentiment. Mixed signals from the U.S. Federal

Reserve, especially regarding the timing of potential rate

cuts, weighed on investor confidence. The Fed’s cautious

stance and a stronger U.S. dollar led to intermittent

foreign outflows, slightly dampening risk appetite.

Inflationary pressures in the U.S. and Europe prompted

further tightening by the Federal Reserve and European

Central Bank, temporarily unsettling global equity flows.

Weak global demand also persisted, particularly

affecting India’s export

oriented sectors such as IT, pharmaceuticals, and

textiles.

These

challenges

underscored

the

interconnected nature of Indian equities with global

macroeconomic dynamics, even as domestic

fundamentals remained robust.

On the domestic front, the Q2 earnings season played a

pivotal role in shaping market behaviour. Stellar results

from large-cap companies such as Tata Consultancy

Services (TCS) and strong operational updates from

several blue-chip firms boosted sentiment in the early

part of the month. The primary market also witnessed

heightened activity, with major IPOs like Tata Capital and

Groww attracting overwhelming investor participation.

These new listings diverted liquidity temporarily but

underscored the deepening retail and institutional

engagement in Indian equities. The influx of new capital

through IPOs and mutual fund inflows highlighted

investors’ growing confidence in India’s structural growth

story.

However, by the final week of October, the market’s

four-week winning streak came to an end as heavy

profit-booking set in. Small-cap stocks, however,

continued to outperform, reflecting investor appetite for

higher-risk, high-reward opportunities. Public sector

undertakings (PSUs), particularly in banking and energy,

emerged as notable outperformers, offering relative

stability amid the broader correction. Conversely, IT and

private banking counters, which had driven much of the

earlier rally, bore the brunt of the sell-off as valuations

turned rich and traders sought to lock in gains.

The interplay of these forces created a turbulent yet

opportunity-rich environment throughout the month.

Sector rotation was a key theme, with investors

dynamically shifting exposure between cyclical,

defensive, and value-oriented plays in response to

earnings updates, policy changes, and global signals.

Among the primary reasons for the late-month correction

were profit-booking after a sustained rally and uneven

performance across key corporate earnings. Regulatory

announcements, including SEBI’s circular affecting large

private banks’ eligibility norms for derivatives, added to

banking sector uncertainty. Meanwhile, global central

banks’ cautious tone and the continued strength of the

U.S. dollar further deterred aggressive risk-taking by

foreign investors.

Despite these headwinds, the broader narrative remained

optimistic. The resilience of PSU banks and strength in

oil & gas counters reflected selective investor confidence

in value sectors. The buoyant IPO market and steady

mutual fund inflows pointed to deepening domestic

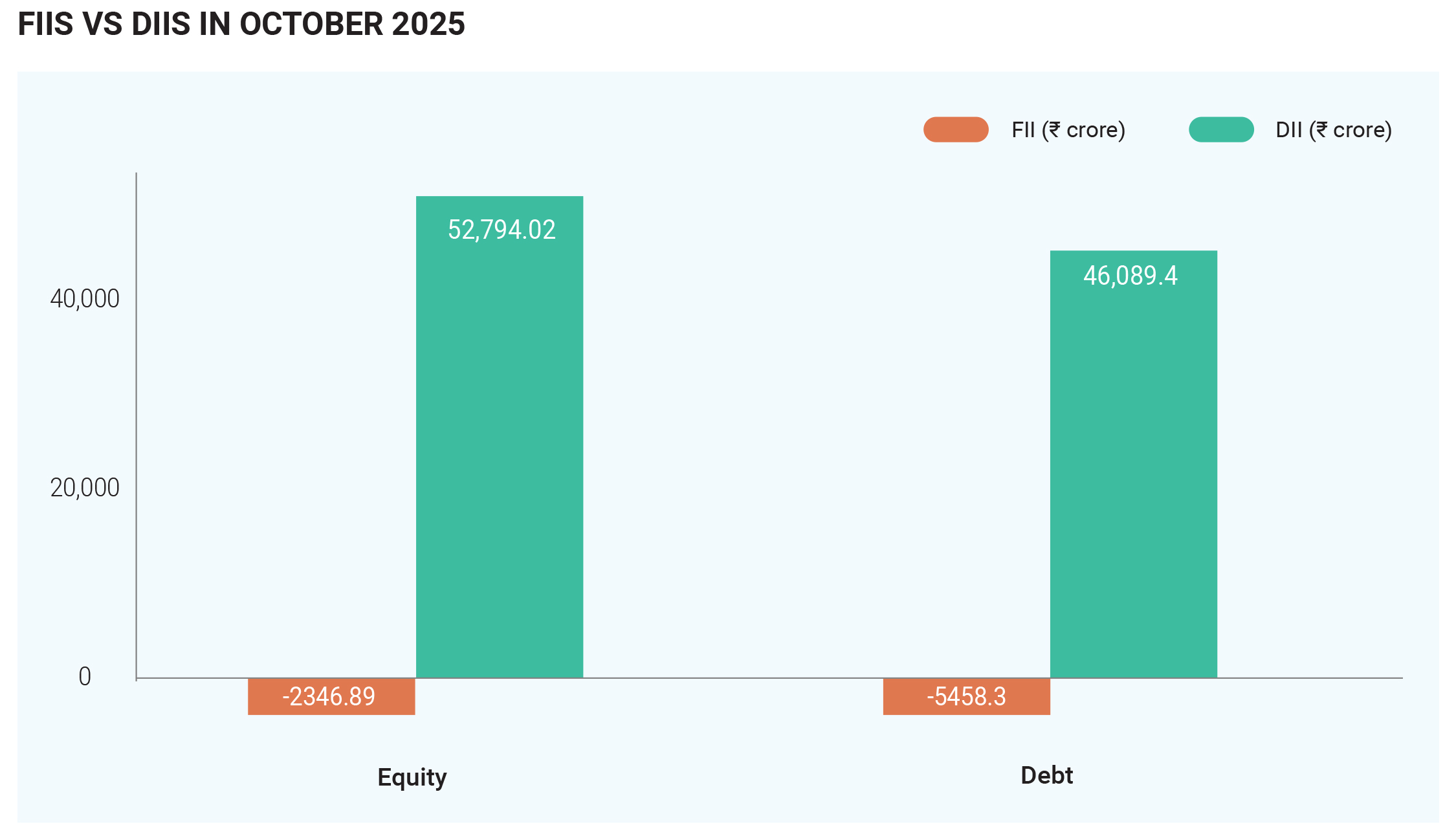

participation. Both foreign and domestic investors

played vital roles in sustaining the market’s strength.

After several months of outflows, Foreign Institutional

Investors (FIIs) returned as net buyers, while Domestic

Institutional Investors (DIIs) maintained consistent

support through steady inflows. This combined

participation helped markets absorb volatility effectively.

FIIs, who had been net sellers from July to September,

reversed course in mid-October, recording their first

positive monthly inflow since June 2025. They

collectively purchased around ₹10,040 crore during the

month, signalling renewed confidence in India’s

macroeconomic prospects. The standout moment came

on October 28, when FIIs logged their largest single-day

purchase—over ₹10,300 crore—marking a decisive shift

from the selling trend of previous months. DIIs remained

steadfast, adding approximately ₹9,537 crore in net

inflows by month-end. Their steady buying offset early

volatility from FIIs and provided a stabilizing cushion

during periods of profit-taking. FIIs particularly increased

exposure to state-run banks, aligning with the PSU

banking rally, while DIIs favoured financials and

consumer-oriented sectors. The revival in FII sentiment

was primarily driven by expectations of a potential U.S.

Federal Reserve rate cut, moderation in the U.S. dollar,

and resilient domestic earnings. Meanwhile, DIIs

continued to deploy funds through systematic

investment plans (SIPs) and tactical sectoral allocations.

Together, these trends underscored renewed global and

domestic confidence in Indian equities.

In conclusion, October 2025 epitomized the dual nature

of India’s stock markets—buoyed by strong domestic

fundamentals

and

corporate

performance

yet

periodically tested by global uncertainties and regulatory

developments. Despite short-term volatility, both the

Sensex and Nifty posted commendable monthly gains of

about 5%, reaffirming India’s standing as one of the most

resilient and attractive investment destinations amid

global turbulence. While short-term consolidation may

persist, the medium-term outlook for equities remains

positive, underpinned by steady economic growth, robust

earnings momentum, and expanding retail investor

participation.