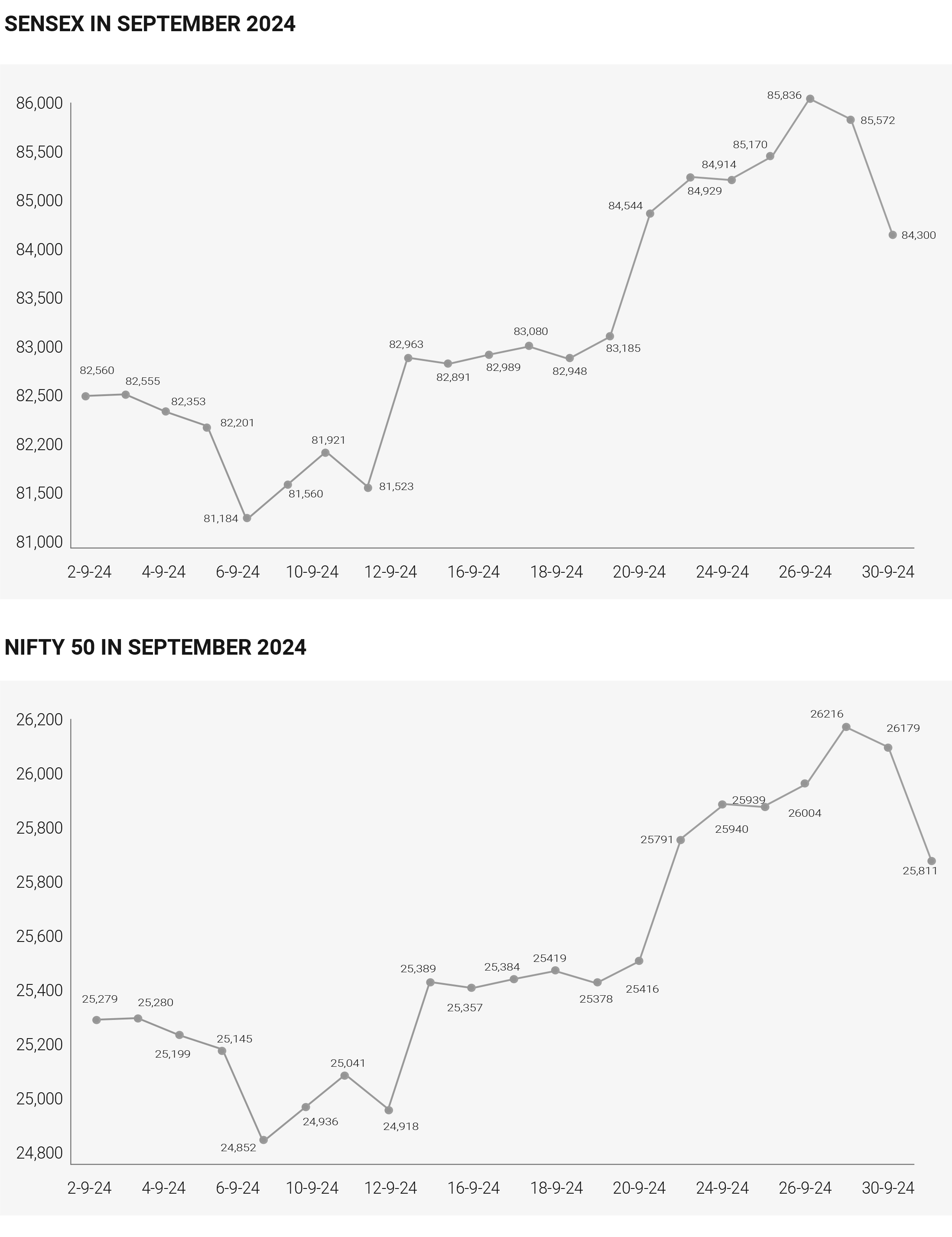

With each month of the year passing by Indian stock markets make new highs along with the significant fluctuations. On September 26, 2024, both indices reached new all-time highs. The Sensex closed at 85,836.12, rising by 666.25 points (0.78%), while the Nifty finished at 26,216.05, up by 211.90 points (0.81%). This rally was driven by strong buying in auto and banking stocks, bolstered by positive global cues and investor confidence following China's economic stimulus measures and the U.S. Federal Reserve's rate cut. The mid-month saw some profit bookings with the markets remaining flat. Then at the end of the month, the market saw a sharp decline on September 30, with the Sensex plummeting by 1,272.07 points (1.49%) to close at 84,299.78 and the Nifty dropping by 368.10 points (1.41%) to finish at 25,810.85. This decline was attributed to profit-taking after reaching record highs and escalating geopolitical tensions in West Asia. September 2024 was characterized by positive developments, such as favourable monetary policy signals from the U.S. and China, alongside challenges including profit-taking and geopolitical tensions that ultimately affected market sentiment and performance. On 18th September 2024, FED announced a 50 basis point rate cut, which initially boosted investor sentiment in global markets, including India. This decision led to increased foreign institutional investment (FII) in Indian equities, contributing to a rally in the Sensex and Nifty, especially on September 19 and 26 when both indices reached record highs. Also China’s announcement of economic stimulus measures, investor confidence surged. This development positively impacted global markets, with the Sensex rallying significantly on September 26, touching an all-time high as investors anticipated improved corporate earnings and economic stability. The auto sector saw gains where the major contributor was Mahindra recorded a growth of 9%. Inflation numbers remained low at 3.54%, on which the investors speculated that RBI would maintain or lower the interest rate in the upcoming MPC meeting. Markets faced significant profit booking on 30th September leading to sharp declines in indices. The global geopolitical tensions such as the Middle East and potential economic slowdown pushed the indices in red. Foreign institutional investors follow the market trend as the volatility increases and FIIs outflows increased pressurising the markets. September 2024 was shaped by a combination of supportive monetary policies from major economies, geopolitical tensions, and fluctuating commodity prices. These factors collectively influenced investor sentiment and trading behaviour in the Indian stock market, leading to significant volatility in the Sensex throughout the month. FIIs invested approximately ₹57,724 crore (around $6.87 billion) in Indian equities throughout September. This marked the highest monthly inflow since December 2023, reflecting strong confidence in the Indian market amid favorable macroeconomic conditions and a supportive global environment following interest rate cuts by the U.S. Federal Reserve. FIIs were also active in the Indian debt market, marking their second consecutive year as net buyers.

In September alone, they infused around ₹1,299 crore (approximately $154.7 million) into debt securities. This continued interest highlighted a shift towards safer investments amid global uncertainties. The debt market in September 2024 was characterized by declining bond yields, strong foreign investment inflows, and supportive liquidity conditions in the Indian debt market. These factors combined to create a favourable environment for fixed-income securities, reflecting positive investor sentiment and expectations for continued growth in the sector. U.S. Federal Reserve Rate Cut interest rates by 50 basis points had a significant impact on global bond markets, including India, raising expectations of lower yields in the Indian debt market as investors anticipated similar easing from the Reserve Bank of India (RBI) in response to global monetary trends. FPIs continued to show robust interest in Indian debt securities, surpassing a net investment milestone of ₹1 lakh crore by August 2024. The yields on Indian government bonds trended lower during September, reflecting a favourable environment influenced by global cues and expectations of further rate cuts. The 10-year benchmark yield fell to around 6.87%, with analysts predicting it could drop further due to anticipated RBI policy adjustments. The Indian debt market benefited from surplus liquidity as the RBI managed liquidity through various measures, including variable reverse repo rate auctions. This surplus liquidity helped keep bond yields low and supported positive sentiment in the debt market. India’s retail inflation rate remained low at 3.54%, which is below the RBI's target. This lower inflation rate reduced concerns about aggressive monetary tightening and supported the case for maintaining or lowering interest rates, further boosting investor confidence in fixed-income securities. Corporate bonds also experienced a softening of yields, moving in tandem with sovereign bonds as investor confidence grew amid favourable macroeconomic conditions and robust demand for fixed-income securities from institutional investors. Global economic conditions, including mixed signals from major economies and geopolitical tensions, influenced investor sentiment in the Indian debt market. The overall positive outlook for emerging markets contributed to increased demand for Indian bonds. The crude oil prices moved into negative territory due to a combination of weak demand from China, rising global supplies, and geopolitical uncertainties that failed to provide price support. The month ended with significant losses for both Brent and WTI benchmarks, reflecting ongoing challenges in the oil market. The Indian Rupee was relatively stable during the month, trading within a narrow range against the U.S. Dollar despite external pressures from global economic conditions and domestic market dynamics. The RBI's interventions were crucial in maintaining this stability, reflecting its commitment to managing currency volatility amid changing economic landscapes. Whereas the Gold prices experienced volatility in September 2024, initially gold prices recovered after the initial decline culminating in a significant increase towards the end of the month. The highest price recorded was ₹56,800, reflecting positive investor sentiment and external economic factors influencing the gold market. Increased demand for safe-haven assets amid uncertainties in global markets contributed to rising gold prices. Also, the changes in the value of the Indian Rupee against the U.S. Dollar impacted local gold prices. Investors need to closely monitor sector performances and corporate announcements during October 2024 as they navigate potential opportunities in the market. It is likely to see a positive influence on the Indian stock markets due to the festive season characterized by increased consumer spending, improved corporate earnings prospects, and heightened market liquidity. The Indian stock markets in October 2024 would have a direct impact on the RBI's monetary policy decisions, inflation trends, economic growth forecasts, foreign investment flows, corporate earnings reports, geopolitical developments, agricultural performance, and prevailing market sentiment.

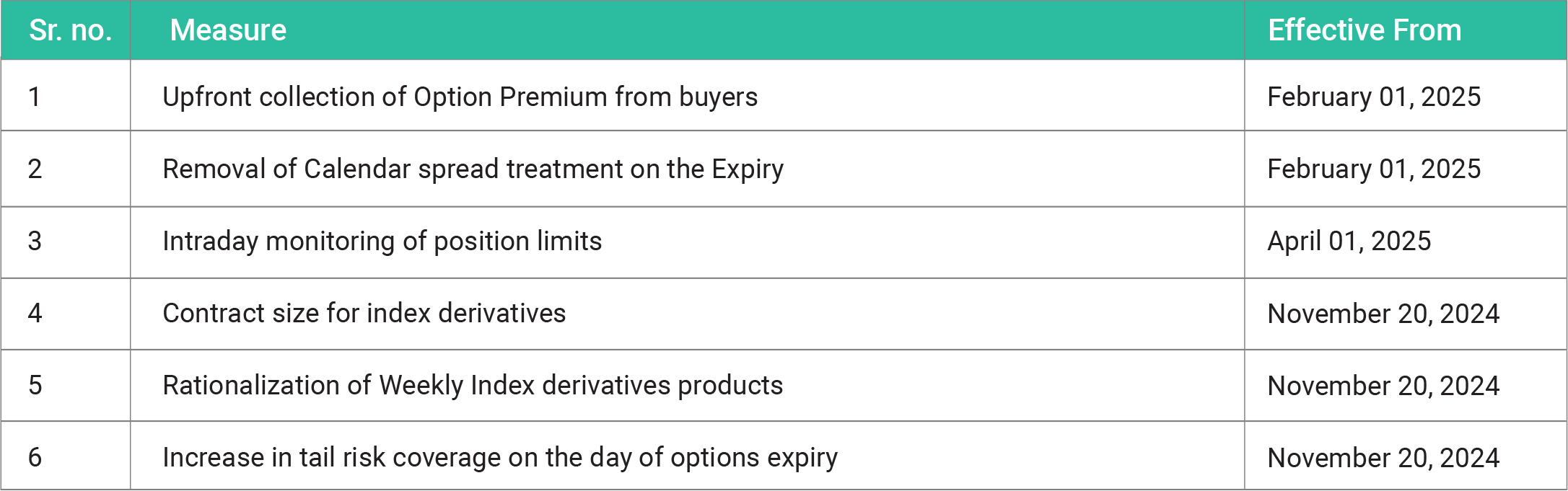

Future and Options trading in India have adversely

affected the retail investors. Stock Exchange of India

introduced new trading rules for F&O which will be

implemented from 1st October 2024. These measures

would curb the concerns about high levels of speculation

in the derivatives market where over 93% of retail traders

reportedly incurred losses in recent years, summing

around Rs.1.8 trillion. By implementing new rules and

regulations SEBI aims to enhance investor protection

and promote responsible trading practices among retail

participants. To simplify the derivatives trading rules

Sebi has made some major changes starting from

October 2024.

• Derivatives contract size is raised from Rs.5

lakhs to RS.15 lakhs, this will inhibit speculative trading

by retail investors. This new contract size will be effective

from 20th November 2024.

• Entire option premium is collected upfront from

buyers. SEBI has mandated the brokers to collect the

premium, which would prevent excessive intraday

leverage and discourage traders from holding positions

beyond their collateral.

• Limited weekly expiration of derivatives to one

benchmark index per exchange. For example, the

National Stock Exchange (NSE) may only offer weekly

expiries for either the Nifty or Bank Nifty, while the

Bombay Stock Exchange (BSE) will offer them only for

Sensex or BankEx. This change is also effective from

November 20, 2024.

• No benefits for calendar spreads on expiry day,

which means that if traders hold positions across

different expiries, they will need to maintain full margin

on expiry day, effective from February 1, 2025.

• Additional Extreme Loss Margin (ELM) of 2% is

introduced which will be applied to short options

contracts on expiry days. This margin is intended to

cover potential risks associated with increased volatility

on these days.

• Stock exchanges will monitor position limits for

equity index derivatives on an intraday basis rather than

at the end of the trading day. This measure aims to

prevent large traders from manipulating the market and

will come into effect in April 2025.

SEBI with these changes restricts the retail investor's

participation which would reduce the speculative activity

in the derivative market. The minimum contract size for

derivatives has been raised from ₹5-10 lakh to ₹15 lakh.

Many small investors with limited capital may find it

challenging to participate in derivatives trading. The new

contract size aims to deter speculative trading among

retail investors who often engage in high-risk strategies

without sufficient capital or experience. SEBI ensures

that only those with adequate financial resources and

risk tolerance participate, potentially leading to a

decrease in reckless trading behaviour. With the

reduction of weekly expiries to one per benchmark index

per exchange, retail traders will have fewer opportunities

for short-term speculative trades. This limitation may

lead to decreased intraday volatility and trading volumes.

Retail investors may shift towards longer-term

investment strategies rather than frequent trading in

derivatives due to the large contract size. The

introduction of an additional Extreme Loss Margin (ELM)

of 2% for short options on expiry days will further tighten

the capital requirements for retail traders. This measure

is intended to protect against extreme market

fluctuations but may also limit the ability of smaller

investors to maintain positions during volatile periods.

While the changes are designed to stabilize the market

and protect retail investors, they may also lead to lower

overall market volatility. This could impact trading

dynamics and reduce opportunities for profit-making

through active trading strategies.

While these measures may present immediate

challenges for retail traders, experts believe they could

lead to a healthier market environment in the long run. By

reducing excessive speculation and promoting

responsible trading practices, SEBI aims to protect small

investors from significant losses that have historically

plagued this segment. Traders and investors should

prepare for these changes and adjust their trading

strategies accordingly as these regulations come into

effect in the coming months.

Copyright © 2021 Fintso