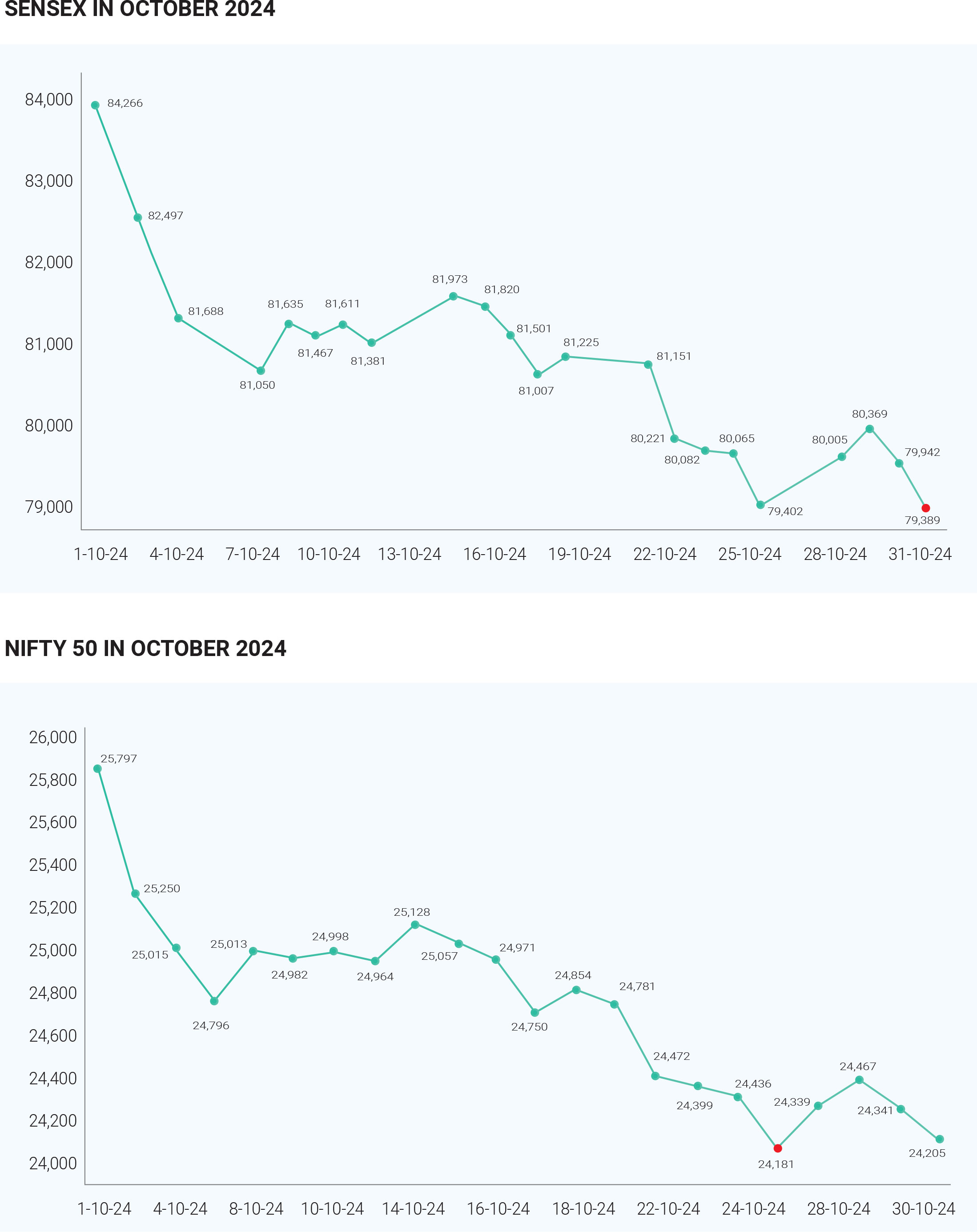

The Nifty 50 closed October 2024 with a substantial decline of 6.2%, marking its worst monthly performance since the COVID-19 pandemic in March 2020. This downturn outpaced the Sensex, which fell by 5.83%. Several factors, including record selling by Foreign Institutional Investors, slower-than-expected corporate earnings, and a potential correction due to overvaluation, contributed to this significant market correction. Markets slipped in the first week of the month Sensex plummeted by 1730 points around 2.05% to close at 82536 whereas Nifty decline by 530 points closing down at 25267. The market took a dramatic plunge, plummeting under the weight of heightened geopolitical tensions in West Asia and the impact of new regulatory measures from SEBI on futures and options trading. The initial crash was just the beginning. The indices continued their downward spiral, battered by relentless selling from foreign institutional investors (FIIs), who had offloaded a staggering ₹93,000 crore in equities by mid-October. The situation worsened with disappointing corporate earnings reports, especially from giants like Hindustan Unilever, further denting investor confidence. On October 28th, a glimmer of hope emerged as the Sensex surged nearly 900 points, closing at a respectable 80,005, while the Nifty climbed to around 24,339. This rally was fuelled by gains in banking and metal stocks, signalling a temporary reprieve amidst the prevailing market anxieties. In turbulent month of October 2024 various sectors, including banking, FMCG, automobiles, gas and energy, chemicals, telecommunications, and retail, witnessed significant declines. IndusInd Bank faced the steepest decline, with its share price dropping by 28.3%, from ₹1,448 to ₹1,038.25. The decline was driven by a 40% drop in net profit for the September quarter, raising concerns about its growth prospects and leading to heavy selling pressure. Other banks also experienced declines due to overall negative sentiment in the financial sector, exacerbated by FII selling. Bajaj Auto saw their stock prices decrease by 20.2%, reflecting broader concerns about consumer demand and economic slowdown affecting vehicle sales. Indraprastha Gas experienced a significant drop of 25.3% in its share price during October, reflecting investor anxiety over future earnings amid rising input costs and regulatory challenges in the energy sector. Retailers such as Avenue Supermarts (D-Mart) reported a 22.2% loss in share value, attributed to fears of reduced consumer spending during the festive season combined with rising operational costs.

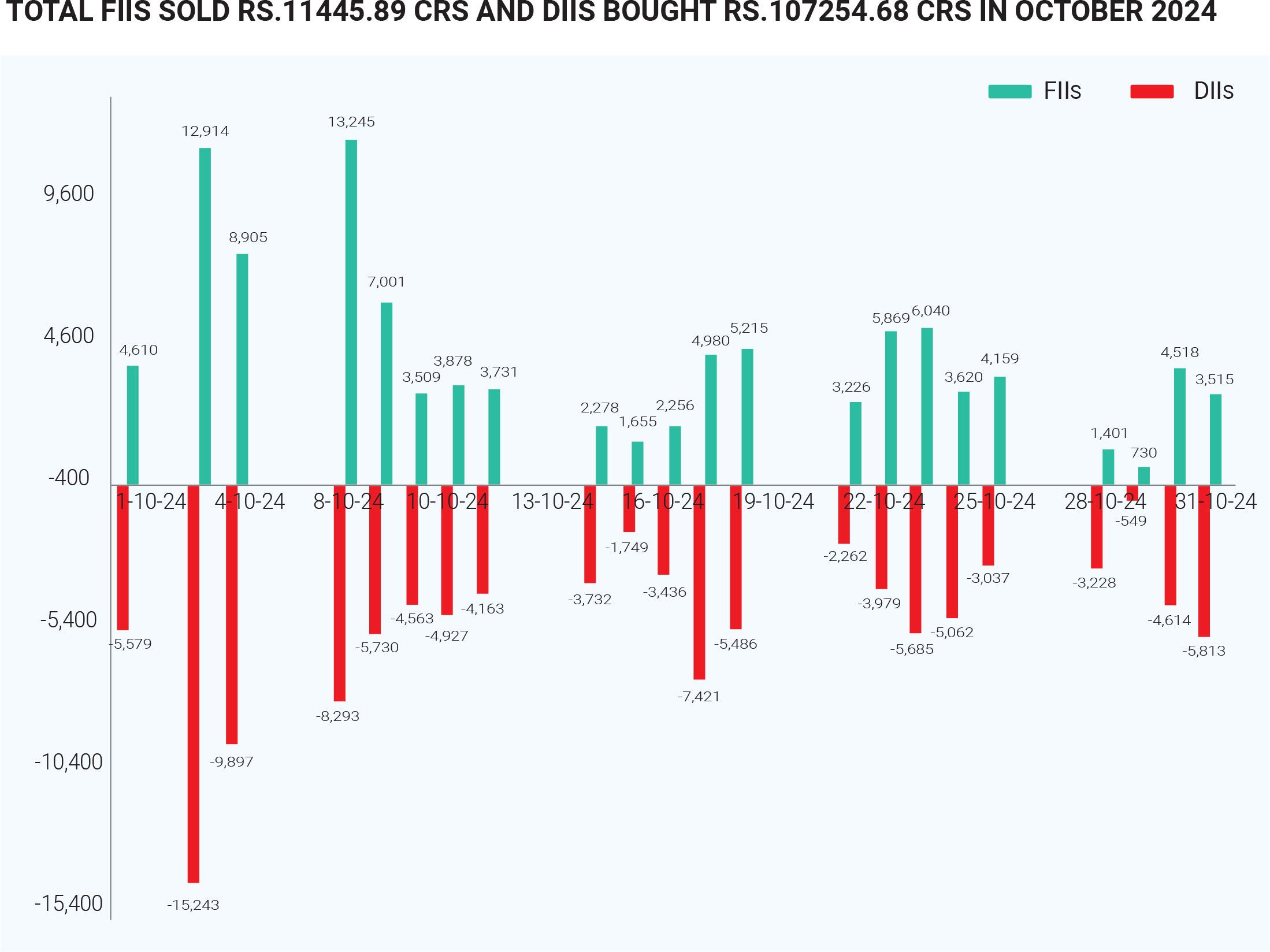

The unprecedented exit by foreign institutional investors (FIIs) was a major catalyst for the market's decline. As investors sought greener pastures in markets like China, where valuations were perceived as more attractive, a relentless wave of selling engulfed Indian equities, casting a long shadow over the month. The contrasting activities of FIIs and DIIs in October 2024 highlight a significant divergence in market sentiment. While FIIs engaged in record sell-offs driven by geopolitical concerns and a shift towards cheaper markets like China, DIIs capitalized on these market conditions by increasing their investments significantly. This dynamic created a tug-of-war effect in the Indian equity markets, with DII buying providing some level of support against the backdrop of substantial FII outflows. FIIs offloaded equities worth approximately ₹85,000 crore (around $11 billion) during the month. This marked one of the highest monthly sell-offs recorded, surpassing previous significant sell-offs during market disruptions, such as in March 2020 due to the COVID-19 pandemic. DIIs made substantial net investments of approximately ₹98,400 crore in October, marking their highest monthly purchasing activity on record. This influx was primarily driven by mutual funds and insurance companies.

Navigating through the turbulent November 2024, investors should steer their focus towards sectors exhibiting resilience, such as banking and metals. Defensive stocks can provide a safe harbour during these volatile times. Mid-cap opportunities may offer potential for growth, but diversification remains paramount to weather the storm. Staying abreast of global cues like ongoing conflict in West Asia also the US elections, and domestic economic policies will be crucial in crafting effective investment strategies during this challenging period

October 2024 was a challenging month for the Indian debt market, characterized by significant FIIs outflows driven by geopolitical tensions and concerns over domestic monetary policy. While DIIs continued to support the market with substantial investments. For the first time since the inclusion of Indian government bonds in the JP Morgan bond indices, FIIs recorded a net outflow of ₹4,697 crore from the Indian debt market in October. This marked a reversal from previous months where there had been inflows. In September, for example, FIIs had net bought ₹1,278 crore worth of debt. The outflows were primarily driven by geopolitical tensions, particularly related to conflicts in West Asia, and rising crude oil prices. The sentiment in the debt market was also influenced by concerns over potential U.S. interest rate hikes and domestic economic indicators. The yield on the benchmark 10-year government bond fluctuated, settling around 6.78% towards the end of October. This yield was influenced by both domestic economic conditions and global cues, including U.S. Treasury yields. Domestic institutional investors (DIIs) remained active in the market, with significant investments continuing to flow into government securities. Debt investors navigated a complex landscape influenced by both domestic and global factors. The outlook for November will depend on evolving geopolitical conditions and responses from central banks across the globe regarding interest rates.

The month was marked by significant volatility in crude oil prices driven by geopolitical tensions, concerns over supply and demand dynamics, and varying global economic indicators. Crude oil prices initially surged due to escalating geopolitical tensions in the Middle East, particularly following missile attacks involving Iran and Israel. This uncertainty led to fears of potential supply disruptions, pushing Brent crude oil prices up to around $78 per barrel early in the month. Towards the end of October, prices stabilized somewhat, with Brent crude closing at approximately $74.53 per barrel on October 25. The market was supported by speculation regarding OPEC+ potentially postponing planned production increases due to concerns over soft demand and rising supply. The ongoing conflict between Israel and Iran heightened fears of broader regional instability, which historically impacts oil supply routes and pricing. Despite geopolitical risks, there were indications of a potential oversupply in the coming quarters. Reports suggested that OPEC+ might adjust its production strategies in response to these dynamics, further influencing market sentiment. Demand concerns were exacerbated by stagnating business activity in Europe and uncertainties surrounding China's economic recovery post-COVID-19 lockdowns. Traders awaited clarity on China's stimulus measures, which could significantly impact global oil demand. And lastly positive signs emerged from the U.S., where refinery processing reached its highest seasonal levels in six years, providing some support for prices amid overall bearish sentiment.

October 2024 was characterized by significant volatility in gold prices driven by geopolitical tensions and economic indicators. While there were periods of price increases due to heightened demand for safe-haven assets, late-month adjustments reflected changing market sentiments and economic forecasts. The overall trend showed a decline in prices compared to earlier highs, with a recorded decrease of approximately 4.4% over the month. The silver prices were also volatile over the month of October due to geopolitical tensions, cultural festive demand due to Dhanteras, and industrial usage in electronics and solar panels. Prices increased notably leading up to the festival but saw some adjustments afterward, reflecting typical market behaviour surrounding significant buying events. At the beginning of October, silver prices were relatively stable, trading around ₹96,900 per kg in major Indian cities. On October 29, silver was priced at around ₹101,000 per kg in Delhi, reflecting increased festive buying activity. As the festivities ends, silver prices began to decline slightly towards the end of the month. By October 31, prices adjusted to approximately ₹97,900 per kg, reflecting some profit booking after the festival-related purchases. The overall trend showed that silver remained a favoured asset during periods of uncertainty and cultural significance.

October 2024 was marked by significant depreciation of the Indian rupee against the U.S. dollar, driven by FII outflows, geopolitical tensions, rising crude oil prices, and global economic factors. On October 1, it was trading around ₹83.48 to the U.S. dollar. The rupee hit a historic low of ₹84.077 on October 18, driven by substantial outflows from equities, where FIIs sold over ₹74,800 crore worth of Indian stocks in just 11 sessions leading up to this point. By October 21, it managed a slight recovery to ₹84.06, but overall sentiment remained bearish. As RBI intervened in the forex market to prevent excessive volatility by selling dollars to stabilize the rupee temporarily. Moving forward, continued monitoring of global economic conditions and domestic policy responses will be crucial for assessing future movements of the rupee.

The performance of equity mutual funds was affected by the overall market decline. While many funds had previously shown strong returns, the volatility in October led to a mixed performance across different categories - Large Cap Funds generally performed better compared to mid and small-cap categories, as they are often more resilient during market downturns. Whereas Mid Cap and Small Cap Funds faced greater challenges, with many funds experiencing declines in returns due to their higher sensitivity to market fluctuations. Despite the market challenges, the assets under management (AUM) for equity mutual funds saw a sequential increase of about 3.10%, reaching approximately ₹26.43 lakh crore. This growth was largely supported by continued inflows from domestic institutional investors (DIIs), including mutual funds and employee provident funds (EPFO). Sectoral and thematic funds gained traction as investors looked for targeted opportunities in infrastructure, healthcare, and financial services. The volatility in equity markets attracted the investors to the debt mutual funds for the safer investment options. Liquid and corporate bond funds remained particularly attractive to investors looking for stability and reasonable returns in a fluctuating economic environment. Hence the debt mutual fund also experienced the mixed performance due to external market pressures and geopolitical concerns. The overall environment highlighted a shift towards more strategic investments within the mutual fund landscape amidst broader market uncertainties.

The health insurance industry in India is expected to

grow at a compound annual growth rate (CAGR) of

12.8%, increasing from $15.1b in 2024 to $23.8b by 2028,

according to GlobalData. The share of health insurance

in the Indian insurance market grew from 6.9% in 2019 to

9.5% in 2023, with a projection to reach 11.0% by 2028.

The Indian health insurance industry is surging ahead,

with projections for a 15% growth in 2024. This upward

trajectory is fuelled by several key factors like medical

inflation continues to drive demand for comprehensive

health insurance coverage, with increasing public

awareness of health risks and the importance of

preventive care is boosting insurance uptake and lastly

favourable regulatory changes are creating a conducive

environment for industry growth. Building on the

remarkable 17.8% growth witnessed in 2023, the industry

is poised to maintain its momentum in the coming

years.The Insurance Regulatory and Development

Authority of India (IRDAI) introduced several significant

changes to health insurance policies effective from

October 1, 2024. These changes aim to enhance

accessibility and affordability for policyholders. Here’s a

summary of the key modifications in Health Insurance

Policies:

* No Age Restrictions: The most notable change is the

removal of the maximum age limit for purchasing health

insurance policies. This allows individuals of any age to

buy health insurance, addressing a long-standing barrier

that previously restricted coverage for seniors.

*Shorter Waiting Times: The waiting period for coverage

of pre-existing conditions has been significantly reduced,

making it easier for policyholders to access necessary

healthcare services sooner.

*Comprehensive Plans: Insurers are now required to

offer a broader range of coverage options, ensuring that

policies cater to various healthcare needs, including

critical illnesses and maternity coverage.

*Increased Security: Policies can no longer deny claims

after five years, providing greater assurance to

policyholders that their claims will be honoured as long

as they have maintained their policy.

*Incentives for Policyholders: Insurers are encouraged to

offer meaningful discounts on premiums, making health

insurance more financially accessible.

*Flexible Refund Options: Policyholders can now expect

more flexible refund policies, allowing them to receive

refunds at any time under specified conditions.

*Enhanced Claims Process: A dedicated claims review

committee will be established to handle disputes and

ensure fair evaluation of claims, improving the overall

claims settlement process.

*Streamlined Processes: The claims settlement process

has been simplified to reduce the time and complexity

involved in filing and processing claims.

These changes are designed to make health insurance

more accessible and affordable for a wider range of

individuals, particularly seniors who often face

challenges in obtaining adequate coverage. By removing

age limits and reducing waiting periods, the IRDAI aims

to foster a more inclusive healthcare ecosystem that

encourages more people to secure health insurance,

ultimately enhancing financial protection against

medical expenses. This initiative reflects a significant

shift towards improving healthcare access in India,

ensuring that individuals can obtain necessary medical

coverage regardless of their age or pre-existing

conditions.

Copyright © 2021 Fintso