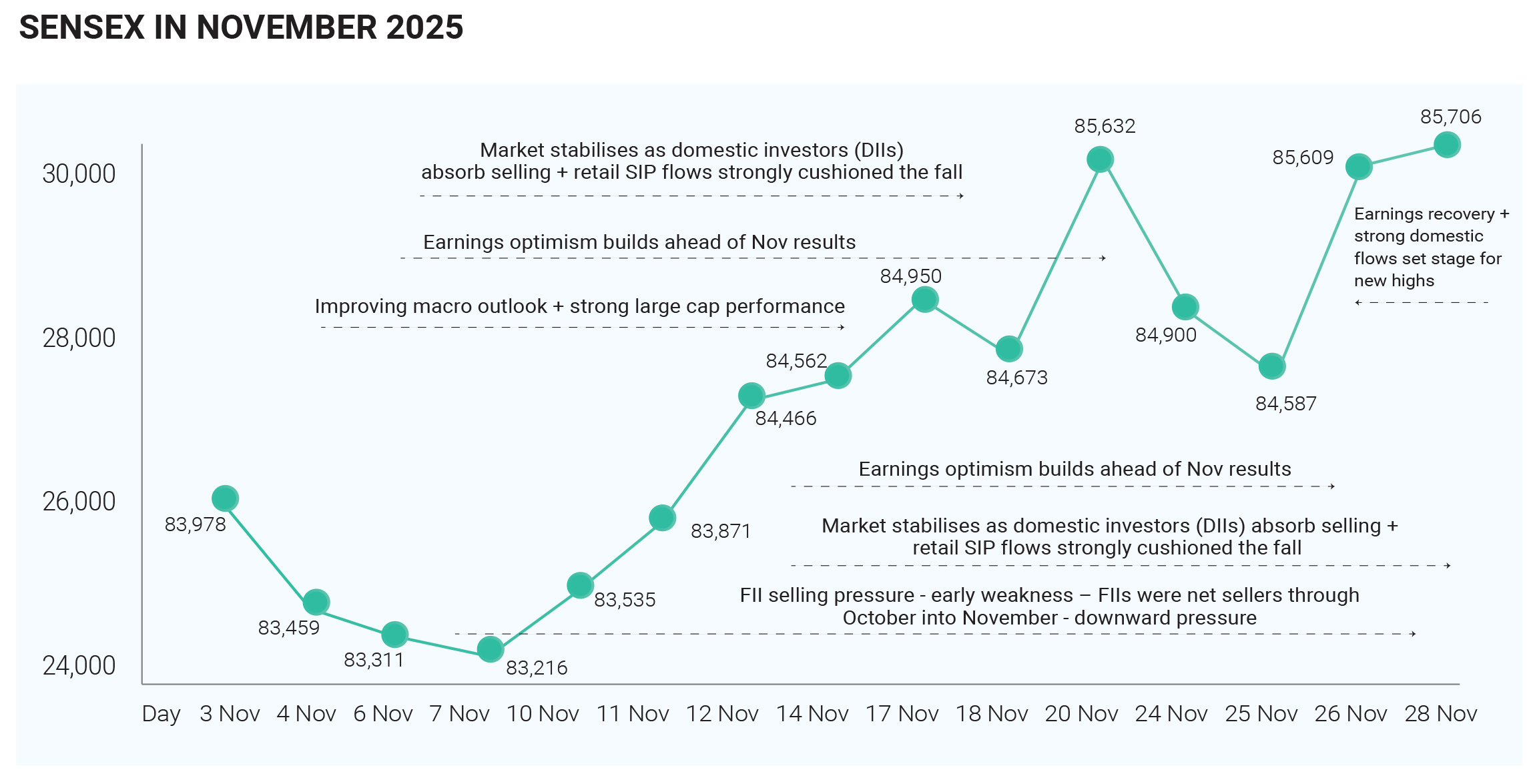

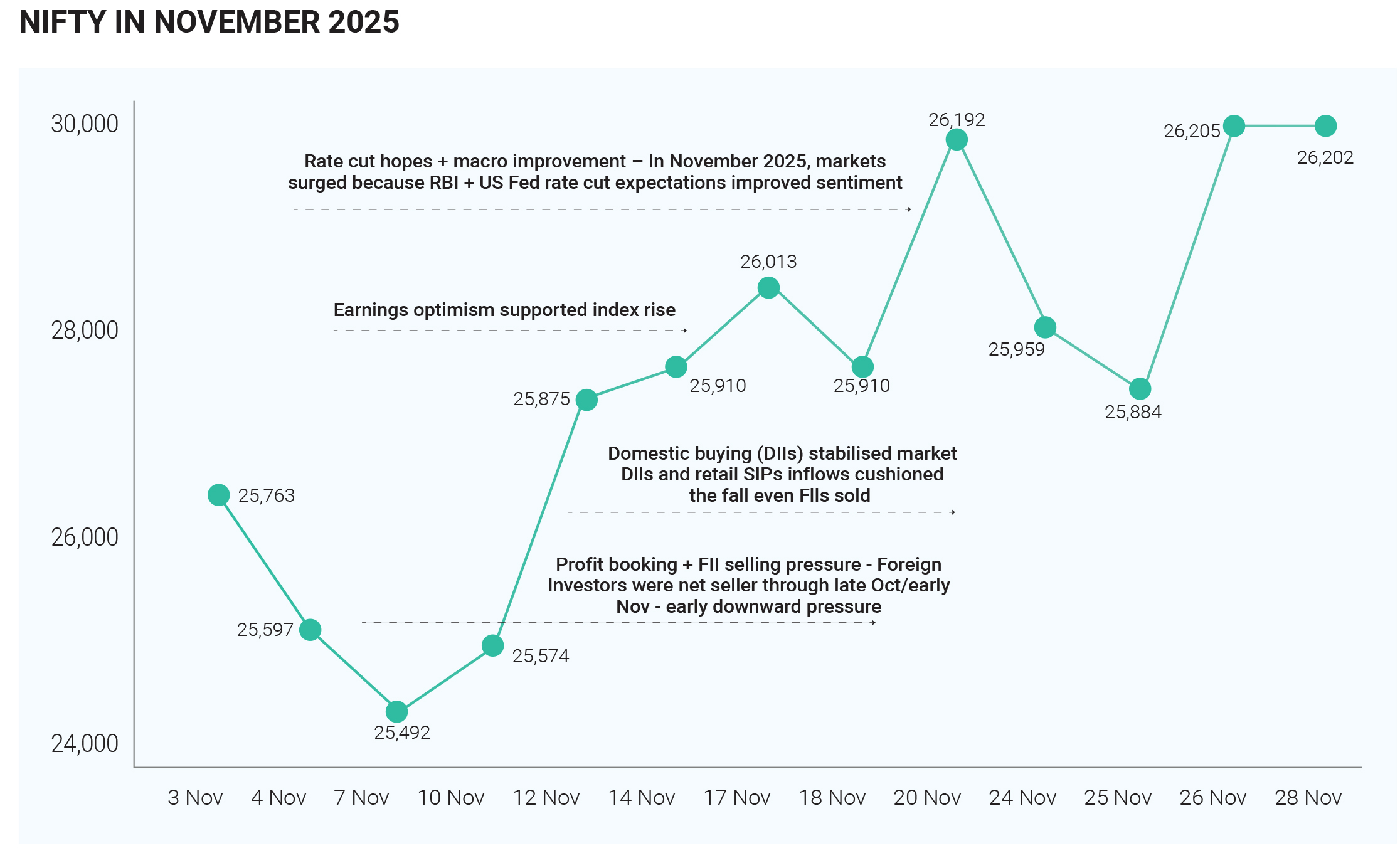

In November 2025, the Indian equity markets continued their upward trajectory, marking the third consecutive month of gains. The Nifty 50 rose by approximately 1.87% during the month, while the BSE Sensex also posted modest gains, oscillating around the 85,000–86,000 range. Despite intermittent volatility and foreign investor selling pressure, domestic institutional support, strong economic data, and sectoral outperformance—especially in technology and healthcare—helped sustain overall market strength. The Sensex touched intraday highs above 86,000 in mid-November before settling slightly lower by month-end. Market breadth remained positive but weaker than in October, with 30 advancing stocks versus 20 declining stocks on the Nifty, resulting in an advance-decline ratio of 1.5. In the final week of November (ending on the 28th), the Sensex gained around 0.56%, reflecting resilience despite turbulence in global and domestic cues.

Technology emerged as the strongest-performing sector

with a weighted return of 4.53%, driven by gains in firms

such as Tech Mahindra, HCL Technologies, and Infosys.

Healthcare also delivered impressive performance at

4.16%, benefiting from defensive positioning and stable

demand. The energy sector gained around 3.49%, lending

additional support to broader indices. In contrast, utilities

proved to be the biggest underperformer, falling by

3.85%. This decline was driven by weakness in

heavyweight stocks such as Power Grid and NTPC,

which were affected by softer power demand and

operational pressures. Consumer defensive stocks also

slipped by 1.95%, reflecting subdued sentiment around

staple goods and cautious consumer spending patterns.

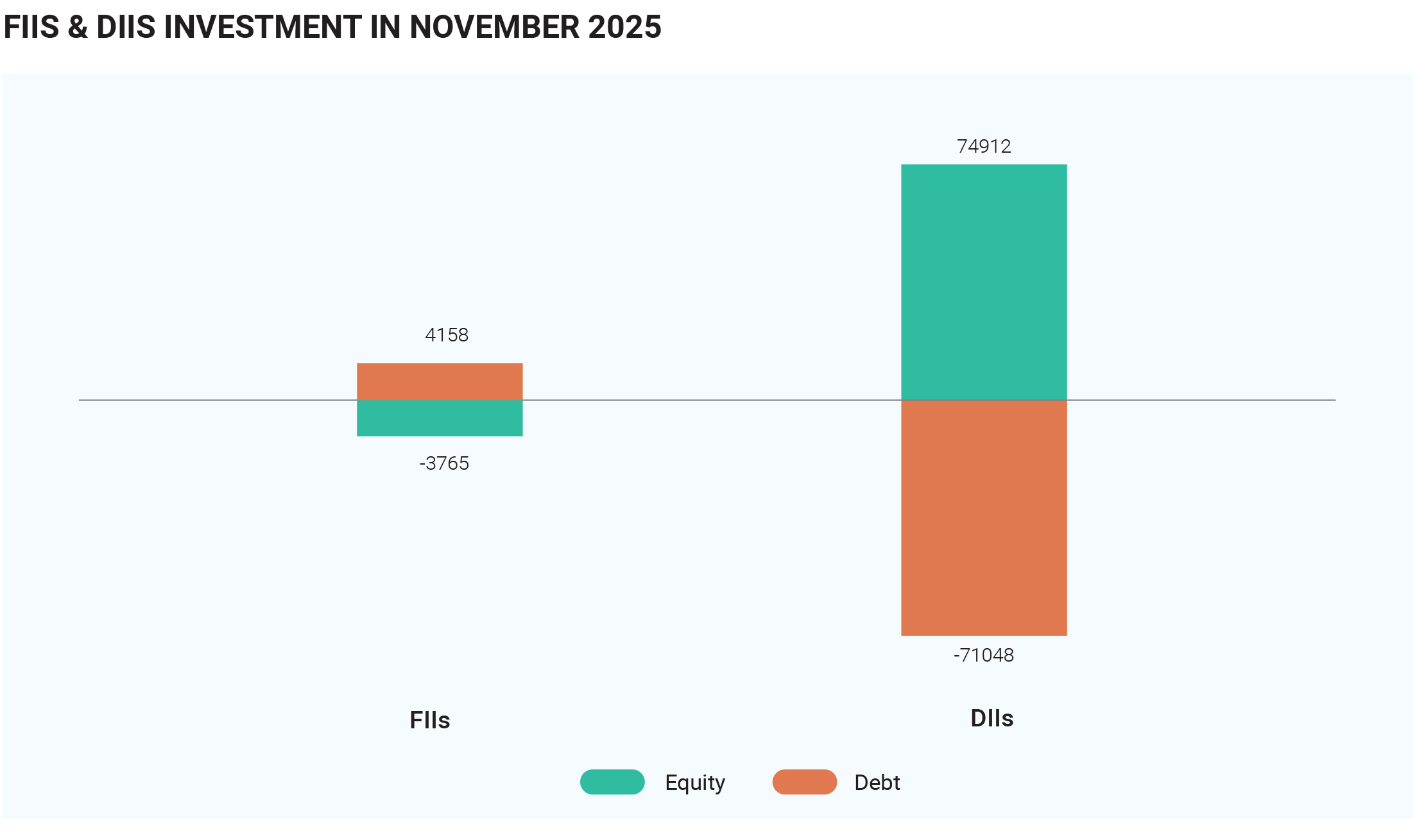

Foreign Institutional Investors (FIIs) emerged as net

sellers in November, pulling out approximately ₹12,500

crore from Indian equity markets in the secondary

segment. This outflow was primarily due to global

portfolio rebalancing towards AI-driven rallies in markets

such as the United States, China, and South Korea. There

were significant days of FII selling, including net outflows

of ₹4,171 crore on November 24 and ₹1,255 crore on

November 27. Although there were some instances of

buying (e.g., ₹4,581 crore on November 7), the overall

monthly trend was negative. However, Domestic

Institutional Investors (DIIs) effectively counterbalanced

the impact of this selling. Indian mutual funds, insurance

companies, and pension funds injected approximately

₹16,600 crore into equities, fuelled by consistent SIP

inflows and rising retail participation. Over the broader

period, DIIs invested nearly ₹77,083 crore (around $8.7

billion), marking approximately 28 consecutive months

of net buying. This sustained influx not only stabilized the

market but also elevated DII holdings above FII holdings

for the first time in recent history. Domestic buying was

concentrated in sectors such as financial services,

FMCG, technology, and healthcare.

Interestingly, while FIIs were net sellers in the secondary

market, they remained active in the primary market. Their

investments in IPOs totalled around ₹10,700 crore,

making November the second-highest monthly FII inflow

in primary markets for 2025. This highlights continued

long-term confidence in India’s structural growth story

despite short-term volatility in stock prices.

Internationally, equity markets experienced turbulence

early in the month. Global technology stocks underwent

a sharp correction, with the Nasdaq Composite falling

nearly 3% in the first week of November. Asian markets,

including Japan’s Nikkei and South Korea’s KOSPI,

dropped around 5% each, while European markets

weakened as well. This selloff was primarily driven by

high valuations and concerns over stretched profit

expectations

related

to artificial

intelligence

investments. As a result, developed market equities fell

about 1.3% during this phase. The longest U.S.

government shutdown in history — lasting 43 days —

ended in mid-November. However, it left behind

uncertainty regarding economic data flow, growth

projections, and potential Federal Reserve decisions.

These concerns led to flat global equity returns for the

month, with developed markets posting gains of just

0.3%. Investors rotated into defensive sectors such as

healthcare and consumer staples. Adding to the

pressure, China’s October trade data revealed a decline in

exports, heightening concerns over weak global demand

and insufficient stimulus measures. This weighed on

commodity prices and emerging markets that are closely

tied to Chinese demand. Geopolitical tensions also

persisted, along with falling energy prices and a

strengthening U.S. dollar. These factors increased

safe-haven demand, easing U.S. Treasury yields but

weakening emerging market currencies. Fiscal

uncertainties—especially UK budget issues and

concerns over U.S. tariffs—further unsettled global bond

and equity markets toward the end of the month.

Despite global headwinds, India showed strong

macroeconomic resilience. Q2 GDP growth surprised on

the upside, coming in at 8.2%, significantly above

expectations. This boosted investor confidence,

especially in sectors such as financials and information

technology. Strong corporate earnings, including major

deals such as TCS’s SAP contract, reinforced positive

sentiment. Mid-cap and small-cap companies posted

profit-after-tax growth of 27–37% year-on-year, adding to

the optimism in the broader market. Another key support

factor was the indication by the Reserve Bank of India of

a possible interest rate cut. With October CPI inflation at

just 0.3%, expectations grew of a policy rate reduction to

around 5.25% in December. This outlook benefited

interest-rate sensitive sectors like banking and

automobiles and supported the broader indices’ gains.

In conclusion, November 2025 reflected a delicate

balance between global uncertainty and domestic

strength. Although FIIs withdrew capital from Indian

equities and international markets remained volatile due

to technology corrections, geopolitical issues, and weak

trade data from China, the Indian market held firm.

Strong GDP growth, RBI’s accommodative signals, robust

corporate earnings, and record domestic inflows

ensured that both Nifty and Sensex closed the month in

positive territory. By early December, the Sensex had

even extended its gains, reaching 85,712 and reflecting a

2.88% upward movement into the new period. This

underlined India’s relative resilience in a challenging

global environment.

In November 2025, India’s debt market remained broadly

stable, supported by the Reserve Bank of India’s

accommodative stance, comfortable domestic liquidity,

and easing inflationary pressures. Although foreign

portfolio investor (FPI) activity created intermittent

volatility, strong local demand and supportive central

bank measures helped moderate sharp yield movements,

allowing bond prices to post modest gains by the end of

the month.

The benchmark 10-year government security (6.33%

2035) yield softened slightly over the period. It declined

from around 6.57% at the beginning of November to

close near 6.50–6.54% by November 28. This gradual fall

in yields reflected mild price appreciation in government

bonds. Liquidity conditions improved during the month,

with surplus liquidity rising to approximately ₹1.2 trillion,

which further supported bond prices and reduced

funding costs for banks and financial institutions.

The yield curve steepened in November as short-term

yields declined more rapidly than long-term yields. This

steepening was driven by the RBI’s surprise repo rate cut

to 6% and a reaffirmation of its accommodative policy

stance. Short-end bond yields were quick to respond to

expectations of easier monetary conditions, while

longer-dated bonds remained stable due to persistent

global uncertainty and elevated international yields. The

5-year government bond yield traded in the range of

approximately 6.11% to 6.20% during the latter part of the

month, while mid-month indicative yields stood around

6.01% for 4–5 year maturities and 6.53% for 9–10-year

maturities.

Money market rates also reflected improving liquidity,

though they ticked up slightly toward the end of the

month. The interbank rate hovered near 5.50%, remaining

mostly rangebound. Expectations of aggressive future

rate cuts faded somewhat as strong GDP growth

forecasts tempered the likelihood of rapid policy easing.

India’s Q2 GDP was projected in the range of 6.5%–6.8%,

highlighting the economy’s resilience and limiting sharp

declines in longer-term bond yields.

On the corporate bond front, yields showed some

firmness despite the RBI’s rate cut. Supply pressures

from increased corporate issuance and cautious

sentiment kept borrowing costs elevated in this segment.

As a result, corporate bond yields did not soften as much

as

government securities, although overall market

conditions remained orderly.

Foreign portfolio investor activity was mixed throughout the

month. Elevated U.S. bond yields—hovering near

4.2%—along with global financial volatility renewed some

pressure on emerging market debt, including India’s. The

Indian rupee also weakened to record lows of around ₹89.55

per U.S. dollar, triggering a partial pullback by some

overseas investors. These factors contributed to modest FPI

outflows at various points during November. However, FPIs

still recorded net inflows of approximately ₹5,760 crore into

Indian debt through Fully Accessible Route (FAR) eligible

bonds. Simultaneously, under the general debt limits, FPIs

invested about ₹8,114 crore. These inflows were partially

offset by outflows of around ₹5,053 crore from the Voluntary

Retention Route (VRR), leading to overall muted, though net

positive, participation. Compared to earlier expectations of

$20–25 billion in annual inflows following FAR expansion,

total year-to-date debt inflows stood lower at around

₹69,073 crore (around $7.8 billion).

Several factors continued to attract foreign interest in Indian

bonds. Yield differentials between India and other major

emerging markets—especially China—remained attractive.

In addition, expectations of further RBI support through open

market operations (OMOs) and the possibility of India’s

inclusion in the Bloomberg Global Aggregate Bond Index

encouraged selective inflows despite the weak currency and

global uncertainties.

Overall, India’s bond market in November 2025

demonstrated relative resilience. While equity markets

experienced volatility and foreign investors turned cautious

in riskier segments, the debt market benefited from stable

inflation (CPI at 3.16%), improving domestic liquidity, and

ongoing RBI support. These factors together contributed to

a mild decline in bond yields and supported overall market

stability, preventing sharp downside movements and

reinforcing confidence in India’s fixed income outlook.

The Indian rupee weakened moderately against the US

dollar in November 2025, declining by approximately

0.8–1.0% over the month. It opened near ₹88.77 on

November 1 and initially traded in a tight and relatively

stable range of ₹88.46 to ₹88.89 through the first half of

the month, with an average rate around ₹88.88. However,

selling pressure increased toward the end of November,

and the rupee slipped to lows of around ₹89.36–₹89.71

by month-end, setting new record levels before declining

even further in early December. One of the primary drivers

of depreciation was sustained Foreign Portfolio Investor

(FPI) equity outflows. During November, FPIs sold Indian

equities worth between ₹12,500 and ₹17,500 crore as

they reallocated capital toward stronger, AI-driven rallies

in US markets and adopted a more risk-averse stance

globally. Since August, total equity outflows had reached

nearly $16.5 billion, increasing dollar demand and putting

sustained pressure on the rupee.

The pressure on the currency was further aggravated by

adverse trade developments. The imposition of 50%

tariffs on certain Indian exports by the United States from

late August significantly affected export inflows. As the

US is India’s largest export market, the trade deficit

widened sharply to a record $41.7 billion in October,

leading to reduced dollar earnings for Indian exporters.

At the same time, importer demand for dollars rose

sharply, particularly for crude oil, gold, and electronics,

deepening the supply-demand mismatch in the foreign

exchange market.

Global factors played a crucial role in the rupee’s

underperformance. A stronger US dollar, US bond yields

hovering near 4.2%, fading expectations of Federal

Reserve rate cuts following strong US jobs data, and

ongoing geopolitical tensions boosted safe-haven

demand for the dollar. Rising Japanese bond yields and

volatility in other Asian currencies also exerted regional

pressure on the rupee, making it one of the

weakest-performing Asian currencies during the month.

As a result, annualised daily volatility increased to around

4.9% in the latter half of November, reflecting heightened

uncertainty. Despite these weaknesses, certain domestic

factors limited a steeper fall. The Reserve Bank of India

maintained an accommodative monetary policy stance

after consumer inflation eased sharply to just 0.3%. This

provided some support to domestic sentiment and

prevented panic-driven selling. In addition, India’s strong

Q2 GDP growth of 8.2% reinforced confidence in the

country’s longer-term fundamentals, helping to absorb

some external shocks. RBI intervention in the currency

market appeared limited once the rupee broke the 88.80

level, but the central bank’s signals and liquidity

management helped slow the pace of depreciation.

Modest FPI inflows into Indian debt, amounting to around

₹5,760 crore, also provided partial support. There was some

temporary relief from optimism around potential US–India

trade negotiations, which helped to briefly stabilise the

exchange rate below ₹89 earlier in the month. However,

these supportive factors were overshadowed by persistent

dollar strength, heavy importer demand, a widening current

account deficit (which reached 1.3% of GDP, the highest in

2025), and continued global uncertainty. By the end of

November, the rupee had firmly crossed the ₹89 mark,

setting the stage for the sharper declines witnessed in early

December.

In summary, November 2025 marked by modest but

meaningful rupee depreciation, driven by strong external

headwinds and capital outflows, partly offset by supportive

domestic fundamentals and cautious central bank

measures.

Crude oil prices declined further in November 2025,

falling by approximately 2.6% over the month as

persistent oversupply and weak global demand

outweighed short-term geopolitical tensions. West Texas

Intermediate (WTI) crude opened near $64.89 per barrel

on November 1 and ended the month around $63.20.

Prices oscillated between a high of $65.10 on November

11 and a low of $61.57 on November 25, reflecting

ongoing bearish sentiment. Repeated failures to break

above the key $65 resistance level reinforced a negative

technical outlook.

The dominant factor behind the decline was a significant

global supply glut. OPEC+ increased production quotas

by 137,000 barrels per day in November, part of a broader

production rise of more than 2.5 million barrels per day

since April. The group’s strategy prioritized maintaining

market share rather than defending price levels. At the

same time, strong output from non-OPEC

producers—especially the United States, Brazil, and

Guyana—added further to excess supply. Global

oversupply was estimated at around 2.7 million barrels

per day, creating unsold cargoes and a rise in floating

storage.

US crude production remained at record levels, with

output holding around 13.6 million barrels per day

through November and forecasts of about 13.5 million

barrels per day for 2025–26. Growing inventories added

to

downward pressure on prices, with estimates

suggesting stock builds of roughly 2.6 million barrels per

day in the fourth quarter. Even new US sanctions on

Russian oil companies and Ukrainian attacks on Russian

refineries caused only brief upward price spikes of

around 5%, as Russian exports continued via shadow

fleets and alternative buyers, preventing any lasting

supply disruption.

On the demand side, economic weakness in major

consuming regions further depressed oil prices. China’s

October trade data indicated slowing exports, reinforcing

concerns of subdued energy demand from the world’s

largest oil importer. Uncertainty around the effectiveness

of Chinese stimulus measures added to bearish

sentiment. In the United States, consumption softened

amid economic and policy uncertainty, while global oil

demand growth was estimated at just 1.1 million barrels

per day—insufficient to absorb the rapid increase in

production.

Geopolitical tensions, including the ongoing Ukraine

conflict and global trade frictions driven by US tariff

policies, contributed to market volatility but did not

significantly disrupt physical supply flows. As a result,

price rallies remained short-lived and were quickly

reversed by technical selling, especially near the 50-day

moving average.

Overall, November 2025 was characterized by excess

supply, weak demand indicators, and strong resistance to

any sustained price recovery. The persistent imbalance

between production and consumption kept crude oil

under pressure, leading to a modest but steady monthly

decline and setting a fragile tone for the market heading

into December.

Gold and silver extended their strong rally in November

2025, supported by heightened safe-haven demand,

global uncertainty, and a powerful surge in

exchange-traded fund (ETF) inflows. Geopolitical

tensions, including Ukraine conflict and instability in the

Middle East, along with volatility in equity markets and

concerns over the US fiscal outlook, encouraged

investors to increase allocations to precious metals as

defensive and diversification assets. The depreciation of

the Indian rupee beyond ₹89 per US dollar further

strengthened domestic investment interest.

Silver significantly outperformed gold during the month,

supported by speculative momentum as well as

expectations of stronger industrial demand from sectors

such as renewable energy, electronics, and electric

vehicles. Uncertainty around China’s economic recovery

and persistent global trade tensions reinforced silver’s

appeal as both an industrial and safe-haven asset.

Meanwhile, weak crude oil prices and fragile risk

sentiment globally continued to push capital toward

alternative stores of value.

Monetary policy expectations also played a crucial role in

driving flows. Growing optimism around potential US

Federal Reserve rate cuts reduced real yields, making

non-yielding assets more attractive. In India, relatively

accommodative signals from the RBI supported

domestic demand for precious metals, even as the

contrast with a more cautious US Fed strengthened the

dollar and added to rupee depreciation pressures.

The most decisive factor behind November’s momentum

was the historic surge in ETF investments. Indian gold

ETFs, which had already recorded a record ₹7,743 crore

of inflows in October, sustained strong buying through

November. Year-to-date inflows reached approximately

₹276 billion (around US$3.1 billion), the highest level ever

recorded. Assets under management in gold ETFs more

than doubled within six months to cross ₹1.02 lakh crore,

while the number of investor folios rose sharply,

reflecting growing participation from both retail and

institutional investors seeking long-term portfolio

protection. At a global level, gold ETF holdings climbed to

around 3,932 tonnes by the end of November, marking

the sixth consecutive month of net additions. More than

700 tonnes were added to global ETFs in 2025,

underlining the strengthening role of gold in strategic

asset allocation. Continued central-bank accumulation,

including additional purchases by China, further

reinforced investor confidence. Silver ETFs registered

even stronger expansion. Assets under management

surged nearly 245% year-on-year to approximately

₹42,537 crore, while investor folios jumped by over 466%

to 25.29 lakh. Although sharp gains prompted some

profit booking, sustained inflows indicated continued

confidence in silver’s long-term structural demand.

Overall, November 2025 highlighted a decisive shift

toward paper-based investment in precious metals, with

ETFs emerging as the dominant driver of market

performance and signalling a more institutional,

long-term phase of the precious metals cycle.

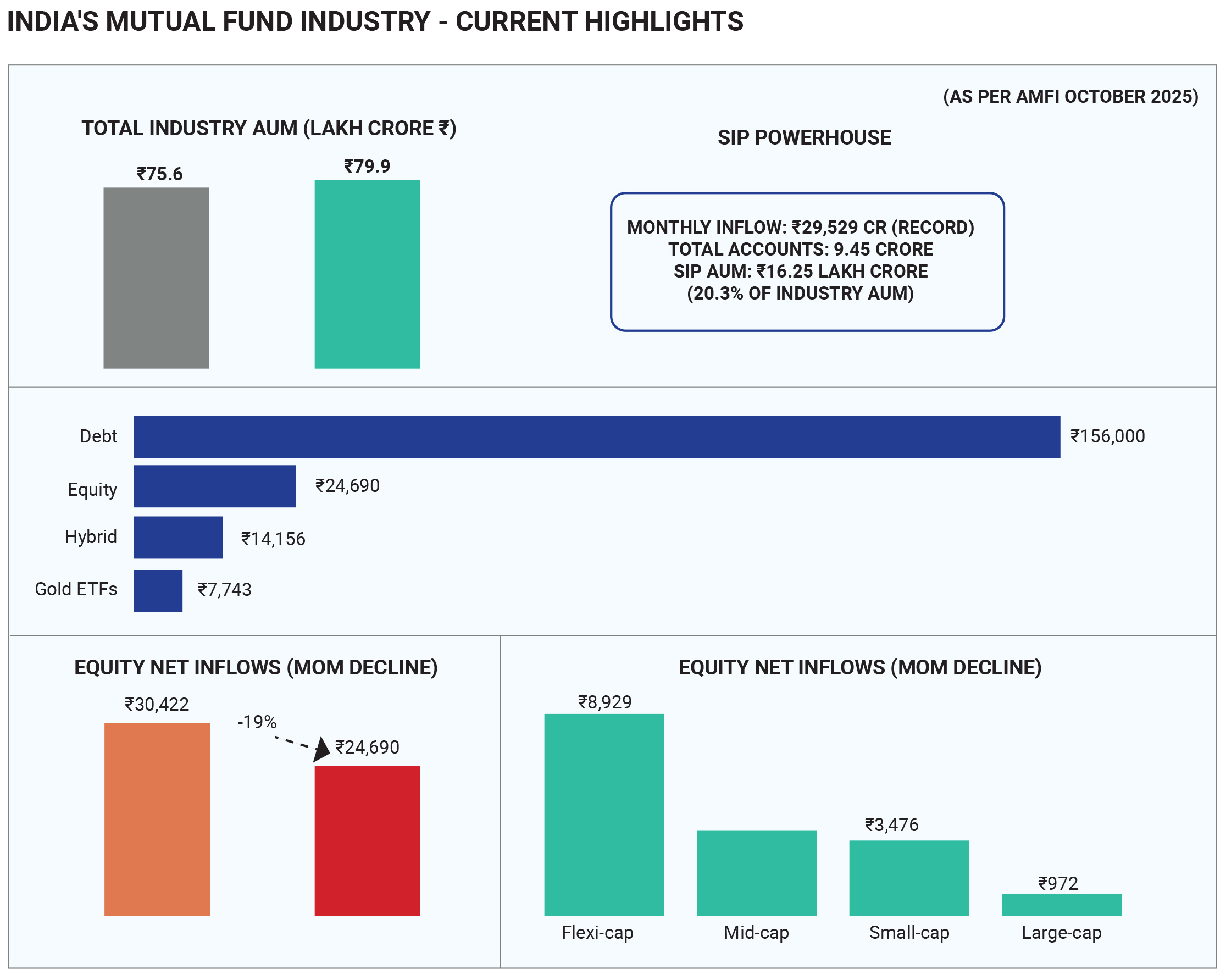

Equity inflows fell 19% MoM to ₹24,690 crore in October

but rebounded late November with Nifty's 1.87% gain;

AUM approached ₹80 trillion, folios hit 23.8 crore, and

gold/silver ETFs recorded YTD ₹276bn inflows. Top

schemes like Nippon India Large Cap (9.88% 1Y)

outperformed amid FII. Funds pivoted to ultra-short debt

amid RBI rate uncertainty and fiscal deficit at 52.6% of

target, cutting long-duration bets as yields stayed above

6.5%.

SEBI proposed eliminating the additional 5 bps charge on

schemes (transitory exit load offset, reduced from 2018),

rationalizing TER definitions excluding statutory levies,

and capping brokerage to enhance unitholder costs.

Reforms tightened fund overlaps (value/contra ≤50%

portfolio), mandated 75% equity in equity funds (up from

65%), permitted sectoral debt schemes (≤60% overlap),

and

expanded

REITs/InvITs/residuals.

hybrids/arbitrage

New

AMC

framework

emphasized digital disclosures, 30-day rebalancing for

passive deviations, up to 6 goal-based target date funds

(3/5/10Y lock-ins), and stricter replication rules.

India’s mutual fund industry AUM reached a record ₹79.9

lakh crore (up from ₹75.6 lakh crore in September),

propelled by mark-to-market gains and robust retail

participation

despite

moderated equity inflows.

Equity-oriented schemes attracted ₹24,690 crore net

inflows—the 56th consecutive positive month—but

declined 19% MoM from ₹30,422 crore, signalling caution

amid volatility; flexi-cap led at ₹8,929 crore, while

large-cap fell to ₹972 crore, mid-cap dropped 25% to

₹3,807 crore, and small-cap eased 20% to ₹3,476 crore.

Debt funds surged with ₹1.56 lakh crore inflows, hybrids

added ₹14,156 crore (arbitrage ₹6,920 crore dominant),

and gold ETFs shone at ₹7,743 crore, reflecting

safe-haven shifts. SIPs hit a second straight record at

₹29,529 crore (+0.57% MoM) from 9.45 crore accounts,

with AUM at ₹16.25 lakh crore (20.3% of industry total).

New fund offers (18 open-ended schemes) mobilized

₹6,062 crore, including ₹4,173 crore from equity; folios

rose to 25.6 crore. Four Specialized Investment Funds

(SIFs) debuted, garnering ₹2,005 crore AUM by

month-end. Overall, growth underscored SIP resilience

and diversification amid FII outflows.

After December 5th , RBI’s 25 bps repo rate cut to 5.25%

(125 bps in 2025) signals continued monetary easing

amid low inflation, strengthening investor confidence.

target, cutting long-duration bets as yields stayed above

6.5%.

SEBI proposed eliminating the additional 5 bps charge

on schemes (transitory exit load offset, reduced from

2018), rationalizing TER definitions excluding statutory

levies, and capping brokerage to enhance unitholder

costs. Reforms tightened fund overlaps (value/contra ≤

50% portfolio), mandated 75% equity in equity funds (up

from 65%), permitted sectoral debt schemes (≤60%

overlap), and expanded hybrids/arbitrage to

REITs/InvITs/residuals.

New

AMC

framework

emphasized digital disclosures, 30-day rebalancing for

passive deviations, up to 6 goal-based target date funds

(3/5/10Y lock-ins), and stricter replication rules.

India’s mutual fund industry AUM reached a record ₹79.9

lakh crore (up from ₹75.6 lakh crore in September),

to

propelled by mark-to-market gains and robust retail

participation

despite

moderated equity inflows.

Equity-oriented schemes attracted ₹24,690 crore net

inflows—the 56th consecutive positive month—but

declined 19% MoM from ₹30,422 crore, signalling

caution amid volatility; flexi-cap led at ₹8,929 crore, while

large-cap fell to ₹972 crore, mid-cap dropped 25% to

₹3,807 crore, and small-cap eased 20% to ₹3,476 crore.

Debt funds surged with ₹1.56 lakh crore inflows, hybrids

added ₹14,156 crore (arbitrage ₹6,920 crore dominant),

and gold ETFs shone at ₹7,743 crore, reflecting

safe-haven shifts. SIPs hit a second straight record at

₹29,529 crore (+0.57% MoM) from 9.45 crore accounts,

with AUM at ₹16.25 lakh crore (20.3% of industry total).

New fund offers (18 open-ended schemes) mobilized

₹6,062 crore, including ₹4,173 crore from equity; folios

rose to 25.6 crore. Four Specialized Investment Funds

(SIFs) debuted, garnering ₹2,005 crore AUM by

month-end. Overall, growth underscored SIP resilience

and diversification amid FII outflows.

After December 5th , RBI’s 25 bps repo rate cut to 5.25%

(125 bps in 2025) signals continued monetary easing

amid low inflation, strengthening investor confidence.

SIPs remain resilient at a record ₹29,529 crore from 9.45

crore accounts and may exceed ₹30,000 crore in

December, supported by 7.3% GDP growth. Lower

borrowing costs are boosting banking, auto, and realty

stocks, improving long-term equity returns despite FPI

outflows, which DIIs continue to absorb. Debt funds may

see strong inflows as yields soften, while hybrid funds

and gold ETFs retain appeal. Overall mutual fund AUM

could cross ₹82 trillion by month-end.

November 2025 marked a turning point for India’s insurance sector as the government prepared to introduce the Insurance Laws (Amendment) Bill 2025 in the sixth session of the 18th Lok Sabha. The proposed bill signalled the most comprehensive reform of insurance legislation in decades, aiming to modernise the Insurance Act (1938), LIC Act (1956) and the IRDAI Act (1999). The most notable change is the proposal to raise FDI in insurance from 74% to 100%, a move expected to attract substantial foreign capital, global expertise and advanced technology into the Indian market. This is likely to improve product variety, service quality, and overall penetration levels, which remain relatively low in India compared to global standards. The bill also proposes composite licences, allowing insurers to offer both life and non-life products under a single entity. This is expected to reduce operational barriers, improve efficiency and encourage bundled and customised insurance solutions. Capital entry norms are set to be drastically reduced – from ₹100 crore to a lower threshold for insurers and from ₹5,000 crore to ₹500 crore for reinsurers. These changes could open the door for specialised, niche players such as health-focused or climate-risk insurers. The introduction of captive insurers for corporates, perpetual registration for intermediaries, and the ability for agents to sell products from multiple insurers further points toward a more flexible and competitive ecosystem. On the regulatory front, the insurance industry was also influenced by parallel developments in the mutual fund space. While SEBI’s consultation on mutual fund regulations raised broader concerns on fee transparency, IRDAI extended the deadline for feedback on its proposed changes to November 24. Additionally, ULIP taxation norms were tightened, with policies having annual premiums above ₹2.5 lakh losing tax exemption under Section 10(10D), discouraging their use purely as tax-saving investment tools by high-net-worth individuals. Together, these reforms support the government’s long-term vision of “Insurance for All by 2047,” promoting higher penetration, greater innovation, increased competition and a more resilient, globally aligned insurance industry.

Copyright © 2021 Fintso